Clarity Traders is a proprietary trading firm that offers various challenge accounts to traders looking to manage funded accounts with significant capital. The firm emphasizes risk management with specific drawdown limits and offers a high profit share.

Key Trading Conditions

- Profit Share: 90%

- Leverage: Up to 1:100

- Instruments: Includes Forex, cryptocurrencies, indices, gold, and other commodities.

- Expert Advisors (EAs): Not allowed

- Copy Trading: Not allowed

- Weekend/Overnight Holding: Not allowed

- News Trading: No information available

- Stop Loss: No information available

Drawdown Rules

- Daily Drawdown: Limited to 5% of the initial equity, adjusted daily based on gains. Breaching this limit results in automatic challenge failure.

- Overall Drawdown: Cannot exceed 8% of the starting capital at any point during the challenge phases. Breaching this limit also leads to automatic challenge failure.

Challenge Accounts

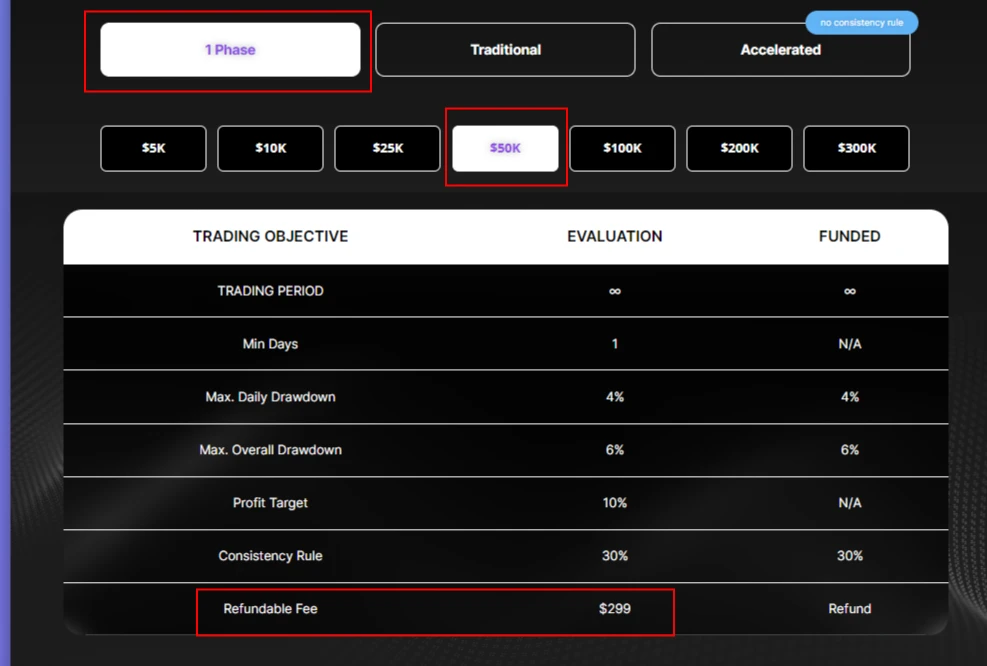

1 Step Challenge Account

- Capital Range: $5,000 to $300,000

- Pricing: From $66 to $1,429

- Trading Period: Unlimited

- Minimum Trading Days: One day in Evaluation, none in funded account

- Drawdown Limits:

- Daily: 4% in Phase 1, and 4% in the funded account

- Overall: 6% in Phase 1, and 6% in the funded account

- Profit Target: 10% in Phase 1, none in the funded account

- Consistency Rule: 30% in Phase 1, 30% in the funded account

- Refundable Fee: Yes

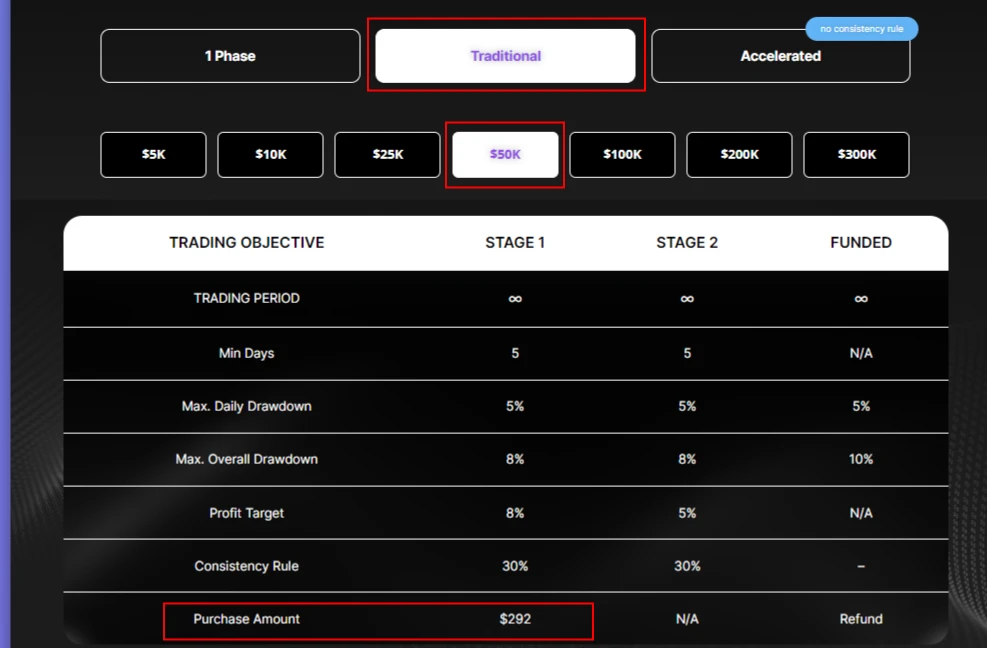

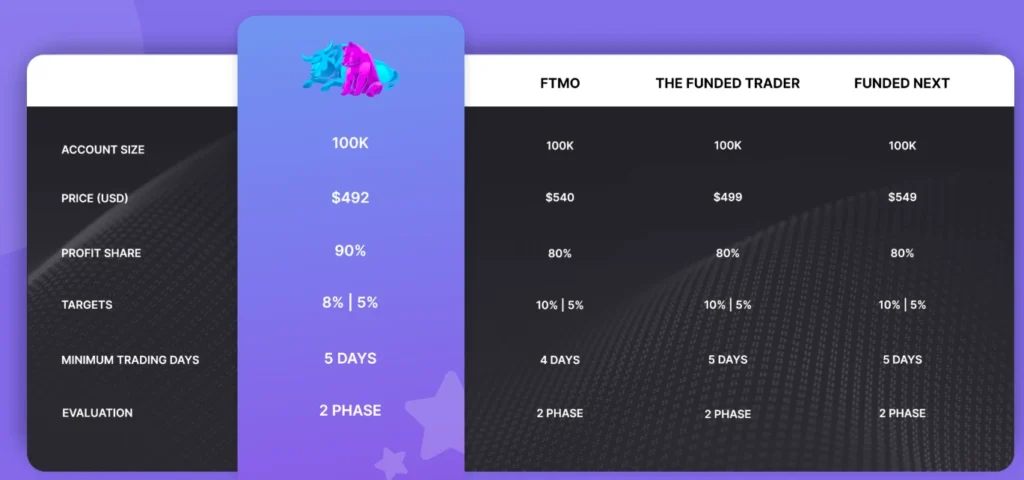

2 Step Challenge Account

- Capital Range: $5,000 to $300,000

- Pricing: From $50 to $1,399

- Trading Period: Unlimited

- Minimum Trading Days: Five days in Evaluation, none in funded account

- Drawdown Limits:

- Daily: 5% in Phase 1 and 2, and 5% in the funded account

- Overall: 8% in Phase 1 and 2, and 10% in the funded account

- Profit Target: 8% in Phase 1, 5% in Phase 2, none in the funded account

- Consistency Rule: 30% in Phase 1 and 2, none in the funded account

- Refundable Fee: Yes

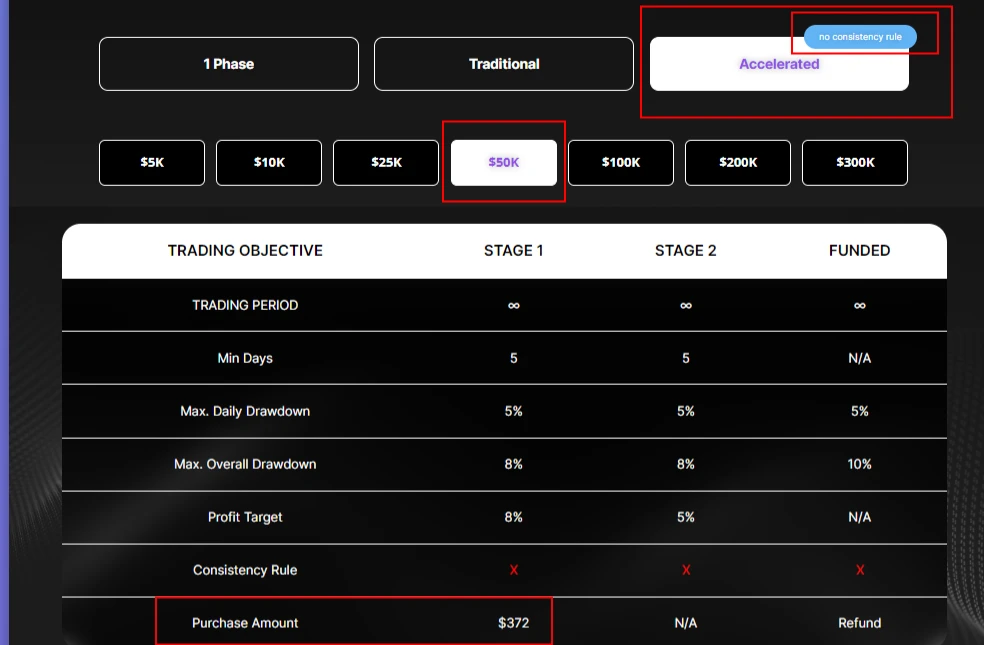

2 Step Accelerated Challenge Account

- Capital Range: $5,000 to $300,000

- Pricing: From $63 to $1,782

- Trading Period: Unlimited

- Minimum Trading Days: Five days in Evaluation, none in funded account

- Drawdown Limits:

- Daily: 5% in Phase 1 and 2, and 5% in the funded account

- Overall: 8% in Phase 1 and 2, and 10% in the funded account

- Profit Target: 8% in Phase 1, 5% in Phase 2, none in the funded account

- Consistency Rule: No consistency rule in the funded account

- Refundable Fee: Yes

Trustpilot Reviews for Clarity Traders

Clarity Traders has an average rating of 3.6 out of 5 stars on Trustpilot, based on 40 reviews, which places it in the category of “Average” among similar financial service providers. Here’s a summary of the customer feedback trends and issues highlighted:

Customer Feedback Highlights

- Positive Experiences: Some users have reported satisfaction with Clarity Traders, noting the competitive pricing and user-friendly dashboard that displays necessary stats and analytics clearly. Users who have successfully navigated the challenge process and received payouts shared positive remarks about their experiences.

- Negative Experiences:

- Access Issues: Several customers complained about not receiving login credentials after passing evaluation challenges, or experiencing login issues with provided credentials.

- Customer Support Concerns: A common theme among unsatisfied customers is the lack of effective support in resolving issues. Customers have reported delayed or unhelpful responses when facing technical problems or account management issues.

- Performance Issues: Some traders noted high spreads that they felt set them at a disadvantage, and others mentioned system instability, specifically with the Trade Locker platform crashing without timely support resolution.

- Account Management: Complaints about account management include difficulties in understanding profit calculations and inconsistencies in the trading rules applied, especially concerning the consistency rule.

General Observations

- Rule Clarity and Enforcement: Some traders expressed confusion over specific trading rules and dissatisfaction with how these rules are enforced or explained by the customer service team.

- Reliability: The mixed feedback on technical reliability and customer service responsiveness has affected some traders’ trust in the platform.

- Recommendations: Despite the challenges, there are users who recommend Clarity Traders, particularly appreciating the no minimum trading days feature and the platform’s overall user interface.

Given the mixed reviews and average rating of 3.6 out of 5 on Trustpilot, potential clients should exercise caution when considering Clarity Traders for their trading needs. While some traders have had positive experiences, significant concerns have been raised about customer support, technical issues, and account management that could impact your trading experience.

Considerations Before Engaging:

- Due Diligence: Thoroughly research and consider all available user reviews and feedback to understand the range of experiences and issues other traders have encountered.

- Risk Awareness: Be aware of the potential risks involved, especially with reported issues such as login problems and lack of responsive support.

- Purchase at Your Own Risk: Engaging with Clarity Traders should be done with careful consideration, keeping in mind that your experience may vary, and you might encounter some of the problems highlighted by other users.

Prospective clients are advised to weigh these factors heavily in their decision-making process to ensure that their choice aligns with their risk tolerance and trading requirements.