Quick Verdict: Is Prop Funders Legit and Worth Your Time?

Prop Funders isn’t a scam, but it’s not perfect either. They offer up to $2.5 million in virtual funding, profit splits that scale to 95%, and some of the fastest payouts in the prop game (4-hour average).

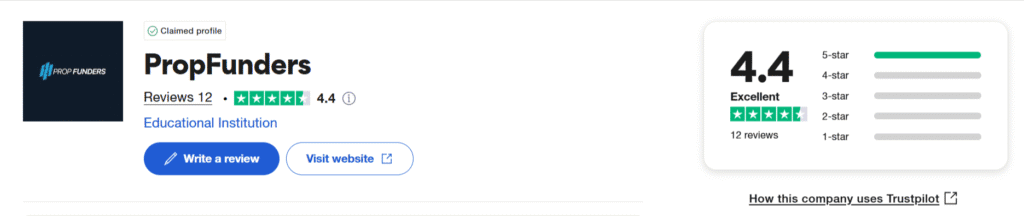

The platform is rated 4.4 on Trustpilot, and their setup works well for traders who want fewer rules. No consistency targets, no limits on profits, and no deadlines to pass your challenge.

If you want to try them out, you can use code PFR for 20% off their entry fee. Use it or don’t—I’m not your dad.

What Sets Prop Funders Apart From Other Prop Firms?

There’s no annoying consistency rules. You don’t have to trade the same way every day, there’s no time limit to pass, and they don’t stop you from making as much profit as you can.

Instead, here’s what you actually get:

- No consistency rules — you don’t have to spread out your profits or pretend to follow a perfect pattern.

- No time limits — take a week or a year to pass. They don’t care.

- Profit splits start at 60%, scale to 95% — if you stay funded and keep payouts flowing.

- Platforms include cTrader, DXTrade, and Match Trader — so you’re not stuck on MT4’s Windows XP interface.

- Swap and swap-free accounts, weekend holding (with paid add-on), and monthly bonuses as you level up.

Sounds trader-friendly, but there’s a trade-off: you’ll need to pay extra for features like holding over weekends, and the add-ons stack fast.

Supported Trading Platforms: cTrader, DXTrade, Match Trader

They offer:

- cTrader (if you’re not in the U.S.)

- DXTrade

- Match Trader

All of them offer raw spreads, lots of trading pairs, and good trade execution. If you’re used to MT5, the change takes some getting used to—but it works just fine.

Prop Funders Funding Programs Explained

Prop Funders has three programs: Instant Funding, 1-Step, and 2-Step. Each one has different rules, prices, and benefits.

If you don’t want to do any evaluation, Instant Funding is for you. But if you’re okay with some extra steps and want to save money, the 1-Step or 2-Step options work too.

Instant Funding Program: Start Trading Immediately

This is the quickest way to get a funded account, just pay and start trading, no profit target needed upfront.

- No evaluation, no target. You pay, you trade.

- Trailing max loss: 6%. It follows your highest equity until you hit 6% gain, then it locks.

- Max daily loss: 3%. Resets daily based on the previous day’s balance, not equity.

- Minimum 5 trading days required before you can request payout.

- Weekend holding allowed with a paid add-on (it’s not default).

- Profit split starts at 60%, scales to 95% if you’re consistent with payouts.

- Refundable fee if you meet certain conditions after payout.

- Pricing: $229 for $5k account, scaling up to $1,699 for $50k.

It’s expensive, especially if you go big. But there’s no evaluation pressure, and that’s the appeal. Use code PFR if you want 20% off—no pressure, just an option.

1-Step Program: Fast-Track Evaluation

You get one shot to reach your goal. It’s easier than a 2-step, but still takes focus and discipline.

- Profit target: 10%.

- Max loss: 6%, daily loss: 3%.

- Minimum 3 trading days, no time limit to pass.

- Weekend holding allowed.

- No consistency rules, which is a plus.

- Fees aren’t refundable, even if you pass.

- Pricing starts at $59 for a $5k account, up to $545 for $50k.

It costs less than Instant Funding, but you still have to show you can trade well. If you hit the drawdown limit, you’re done—no second chances.

2-Step Program: Traditional Evaluation with Two Stages

This one gives you the most room for mistakes, but it takes more time. If you’re patient and can trade with control, it could be a good fit.

- Level 1: 10% target, 10% max loss, 5% daily loss.

- Level 2: 5% target, same drawdown rules.

- Minimum 3 trading days per phase, no expiry.

- Weekend holding allowed.

- Leverage: 1:50 — the highest of all their programs.

- Fees are non-refundable.

- Pricing: $59 for $5k account, up to $775 for $150k.

This setup is a lot like FTMO’s, but with higher leverage and no time limit to pass.

How Drawdown and Loss Limits Work on Instant Funding

Instant Funding isn’t “easy mode.” It just shifts the risk. Instead of proving yourself with a demo, you’re being watched from the start.

Here’s how it works:

- Trailing drawdown: 6%.

This follows your highest balance until you’ve made a 6% gain. After that, it locks.

Example: If you grow a $10,000 account to $10,600, your max loss locks at $10,000.

Drop below that, and your account is gone. - Daily loss: 3%.

This resets every 24 hours and is based on the balance at the end of the previous day.

If you finish the day at $12,000, you can’t lose more than $360 the next day.

Example:

You end Tuesday with $12,000.

On Wednesday, if you lose $361—even if it was a smart trade that hit a bad spike—your account is closed.

Soft Breach vs. Hard Breach

- Soft breach:

You broke a rule (like trading during news within the 3-minute restricted window). You don’t lose the account, but you won’t get credit for any profit made during that time. - Hard breach:

You hit max loss, daily loss, or use banned strategies like latency arbitrage. The account is closed for good—no refund, no appeal.

Rules and Limits Across All Programs

Prop Funders gives you more breathing room than most, but that doesn’t mean it’s a free-for-all.

What they don’t care about:

- Consistency rules? Nope.

- Profit caps? Also nope.

- Time limits? You can take your sweet time.

What they do care about:

- News trading: Allowed, but no trades within 3 minutes before/after a red-folder event.

- Restricted strategies: No latency arbitrage, no group trading, and no shady EAs. If it feels scammy, it’s banned.

- Weekend holding: You can do it, but only with add-ons on Instant Funding. Included by default in the other programs.

- Refundable fees: Only available for Instant Funding, and only after you hit payout.

The vibe here is “freedom, but don’t be an idiot.”

Who Should Use Prop Funders? Scalpers, Swing Traders, Algo Traders?

Prop Funders is built for traders who like freedom and can manage risk on their own.

- Scalpers and news traders are allowed, as long as they follow the timing rules (no trading within 3 minutes of news).

- Algo traders can use expert advisors (EAs), but not ones that use tick scalping, latency tricks, or Martingale strategies.

- Swing traders can hold trades over the weekend—it’s included in the 1- and 2-Step plans, or available as an add-on in Instant Funding.

If you trust your strategy and don’t want limits on how you trade, it’s a good match.

Payout Structure, Profit Splits, and Withdrawal Speed

Prop Funders isn’t just fast—they’re one of the fastest.

- Profit split starts at 60% on all funded accounts.

- Scales up to 95% if you’re consistent with payouts and performance.

- Monthly bonuses kick in at the Senior Trader level—adds $100 to $500 per month, depending on account size.

- Payouts average 4 hours. Not next day. Not “in queue.” Hours.

There’s also a scaling plan that can take you up to $2.5 million in capital.

It takes time and steady results, but the path is clear if you’re consistent.

How Prop Funders’ Scaling Plan Works in Detail

The scaling plan is straightforward: trade well, get paid more, then manage more capital.

- Account balance scales by 20–30% after every batch of solid performance.

- You need at least 4 payouts and a 10% overall profit before scaling kicks in.

- Once triggered, your capital and profit share both increase, starting at 60%, rising to 95% if you consistently avoid breaches.

Example path to Master Trader:

| Level | Profit Split | Requirements |

| Funded Trader | 60% | Entry level |

| Junior Trader | 70% | 2 payouts + 5% profit |

| Senior Trader | 80% + bonus | 3 payouts + 7% profit |

| Master Trader | 95% | 4+ payouts + 10% profit + no breaches |

This isn’t a quick jump. You need to follow the rules, keep making profit, and earn regular payouts to move up.

Trust and Reputation: Is Prop Funders Reliable?

They’re not anonymous ghost operators—and that already puts them ahead of half the industry.

- Founded by industry vets with 40+ years combined trading experience.

- UK-based, and they’re transparent about the people behind the project.

- Trustpilot rating: 4.4, with positive reviews focused on support and payout speed.

- Active Discord community, where traders regularly report payouts and share progress.

- They invest in tech (Match Trader, DXTrade) and claim to put profits back into infrastructure, not influencer campaigns.

- Bonus points for community projects and charity contributions, which most firms don’t bother with.

They’re still new, so only time will tell how they hold up long-term.

But at least you know who’s running it. That’s more than you can say for half the industry.

Prop Funders vs FXIFY vs Maven Trading: Which Prop Firm Is Right for You?

| Feature | Prop Funders | FXIFY | Maven Trading |

| Max Funding | Up to $2.5 million | Up to $400,000 | Up to $1,000,000 |

| Profit Split | Starts at 60%, scales up to 95% with consistent payouts | Up to 90% (with add-ons) | 80% standard, 85% pro |

| Evaluation Programs | Instant Funding, 1-Step, 2-Step | 1-Step, 2-Step, 3-Step, Instant Funding, Lightning Challenge | 1-Step, 2-Step, 3-Step Challenges |

| Entry Cost | Instant Funding from $229 for $5k account; 1-Step from $59 | From $39 for $5k One Phase, up to $1,599 for $400k Instant Funding | From $15 for 1-Step challenge up to $379 depending on account size |

| Trading Platforms | cTrader, DXTrade, Match Trader | MT4, MT5, DXTrade | cTrader, Match-Trader, TradingView integration |

| Leverage | 1:30 (Instant Funding), up to 1:50 (2-Step program) | Up to 50:1 | Up to 75:1 (Forex), 20:1 (commodities & indices) |

| Max Drawdown | 6% trailing (Instant Funding), 6-10% balance based (1 & 2-Step) | 6%-10% trailing depending on phase | 5% trailing (1-Step), 8% static (2-Step), 3% static (3-Step) |

| Daily Loss Limit | 3%-5% depending on program | 3%-4% depending on evaluation | 2%-4% depending on challenge |

| Minimum Trading Days | 3-5 days (varies by program) | 5 days | Not explicitly stated |

| News Trading | Allowed with restrictions (±3 minutes around news) | Allowed | Allowed with restrictions |

| Weekend Holding | Allowed with add-ons (Instant Funding); included in 1 & 2-Step programs | Allowed | Allowed with add-on |

| Refundable Fee | Yes (only on Instant Funding) | 100% refundable on evaluation fees | Yes, refundable on all challenge fees |

| Payout Speed | Average 4 hours | First payout on demand, thereafter bi-weekly | Every 10 business days |

| Scaling Program | Yes, up to $2.5M with incremental profit share increases | Yes, up to $4M | Yes, scale up to $1M |

| Trading Instruments | Forex, CFDs, metals | 100+ instruments: Forex, stocks, metals, indices | Forex, commodities, indices, crypto |

| Trading Rules | No consistency rules or profit caps; flexible rules including swap/swap-free accounts | No consistency rules; customizable with add-ons | Strict rules: no HFT, no excessive scalping, no arbitrage; must follow IP and behavior policies |

| Community & Support | Active Discord, multilingual support | Large Discord community, responsive support | Active Discord with 60k+ members; 24/7 live chat support |

| Unique Selling Points | Huge max funding, monthly bonuses, flexible platforms, instant funding with trailing drawdown | Instant payouts from first trade, multiple program tiers, backed by broker | Cheapest entry fees, buyback feature for failed accounts, high leverage, solid payout reliability |

| Country / Location | United Kingdom | United Kingdom | Canada |

Key Takeaways:

- Prop Funders is great for traders looking for large funding, flexible platforms (like cTrader), fast payouts, and a profit share that can reach 95%. The Instant Funding plan is strong, with a 6% trailing drawdown and monthly bonuses.

- FXIFY, as covered in our FXIFY review, fits traders who want multiple evaluation choices, instant funding with first payout on demand, and access to many trading instruments. It also offers solid 50:1 leverage and a reliable payout process.

- Maven Trading, highlighted in our Maven review, is the budget pick, with entry fees starting at just $15, up to 75:1 leverage, and simple challenges. You can buy back your account after a breach, and it’s a good option if you want cheap funding and don’t mind using cTrader or Match-Trader.

Final Verdict: Should You Choose Prop Funders?

Prop Funders is a legit option if you’re after freedom, fast funding, and fewer restrictions.

Its no-nonsense rule set, fast payouts, and platform variety make it a solid choice—especially for scalpers, swing traders, and news traders.

It’s not ideal if you’re extremely risk-averse or need refundable fees on every program. Only the Instant Funding option includes that.

But if you’re confident in your trading and want clear rules, fast scaling, and a shot at 95% profit share, Prop Funders stands out in a market full of lookalikes.

Use code PFR for 20% off if you’re giving it a shot.

Or don’t. I’m not your financial advisor.

FAQs

Is Prop Funders legit?

Yes. They’re rated 4.4 on Trustpilot, offer fast payouts, and have transparent rules backed by a real support team.

Can I trade news and hold trades over weekends?

Yes. News trading is allowed, but you must avoid opening or closing trades within 3 minutes before or after major news events. Weekend holding is available as an add-on for Instant Funding and is included by default in 1-step and 2-step programs.

What is Instant Funding and how does it work?

With Instant Funding, you skip evaluations completely—just pay and start trading. The model includes a 6% trailing drawdown, 3% daily loss limit, and allows payouts after 5 trading days.

How fast are payouts and what is the profit split?

Payouts typically take around 4 hours. You start with a 60% profit split and can scale up to 95% with consistent performance and no rule violations.

Are Expert Advisors (EAs) allowed?

Yes, EAs are allowed—but with restrictions. Latency arbitrage, group trading, and prohibited bots are not allowed. Stick to legitimate tools to avoid getting banned.

![Funded Picker Review (2025) + 15% Discount Code [PFR15] 11 funded picker](https://propfirmreviews.net/wp-content/uploads/2025/08/funded-picker-1024x576.jpg)