Funded Prop BX by Baxia Markets, is a proprietary trading firm that provides up to $200,000 in risk capital to traders through a series of structured trading challenges. The firm uses a simulated trading environment powered by Baxia Markets to evaluate trader performance.

Key Features of Funded Prop BX

Funded Prop BX, integrated with Baxia technology, addresses the challenge of accessing substantial risk capital faced by traders globally. The firm offers a range of trading challenges, including the Classic, Wall Street, and Oxford Challenges, to assess and develop traders’ skills within a controlled environment.

Challenges and Educational Support

Available Challenges:

- Classic Challenge: Targets foundational trading skills.

- Wall Street Challenge: Focuses on high-volatility trading strategies.

- Oxford Challenge: Designed for advanced trading techniques.

Educational Resources:

- Comprehensive training modules and direct prop support ensure that traders are well-prepared and supported throughout their trading journey.

- Dedicated servers in Meta London promote low-latency trading, essential for real-time decision-making.

Trading Conditions

- Account Sizes: Options range from $6,000 to $200,000, with both swap and swap-free account choices.

- Profit Share: Begins at 15% during the challenge phase and can reach up to 90% once traders qualify for a funded account.

- Leverage: Up to 1:100.

- Additional Features: Include news trading, weekend holding, the use of expert advisors, and trade copiers.

Incentives and Support

- Reset Options: A 10% discount on challenge resets is available to support traders needing a second attempt.

- Refundable Fee: Initial registration fees are refundable upon promotion to a funded account.

Additional Features

- Instant Challenge Activation: Allows traders immediate access to their dashboard and accounts.

- Risk Management Certificates: Awarded to traders who demonstrate effective risk management.

- Scaling Plan: Consistently profitable traders can increase their account balance by 40% every four months, up to a maximum of $4 million.

Profit Sharing and Objectives in Funded Prop BX Challenges

Funded Prop BX offers a profit share arrangement during the challenge phases, allowing traders to retain a significant portion of the profits they generate. This setup is designed to reward traders for their discipline and expertise throughout the trading challenges, including the Classic, Wall Street, and Oxford Challenges.

Profit Share Details:

- During the Challenge Phase: Traders receive a 15% profit share from the profits earned during the challenge steps.

- Example: For a trader participating in a $6,000 Classic Challenge, if the profit targets of $600 in Step 1 and $300 in Step 2 are achieved, the trader would receive $90 (15% of $600) plus $45 (15% of $300), totaling $135 as profit share.

Profit Targets and Trading Conditions:

- Classic Challenge:

- Step 1 Profit Target: 10%, requiring a $600 gain on a $6,000 account.

- Step 2 Profit Target: 5%, requiring a further $300 gain.

- Wall Street Challenge:

- The entire challenge has a uniform profit target of 10%.

- Oxford Challenge:

- Step 1 Profit Target: 8%.

- Step 2 Profit Target: 5%.

Loss Limits:

- Maximum Daily Loss:

- Set at 5% for the Classic and Oxford Challenges.

- Limited to 3% for the Wall Street Challenge.

- Maximum Overall Loss:

- 10% for the Classic and Oxford Challenges.

- 6% for the Wall Street Challenge.

These parameters are designed to ensure that traders manage risk effectively while striving to meet profit targets within the designated trading conditions. The structure of these challenges is intended to prepare traders for managing larger accounts, where disciplined risk management and strategic planning are crucial.

Funded Prop BX Trading Challenges

Each challenge aims to allow traders to showcase their trading skills and gain access to larger capital amounts, contributing to their potential career advancement in trading. The structured format provides clear objectives and performance metrics, critical for assessing and enhancing trader capabilities.

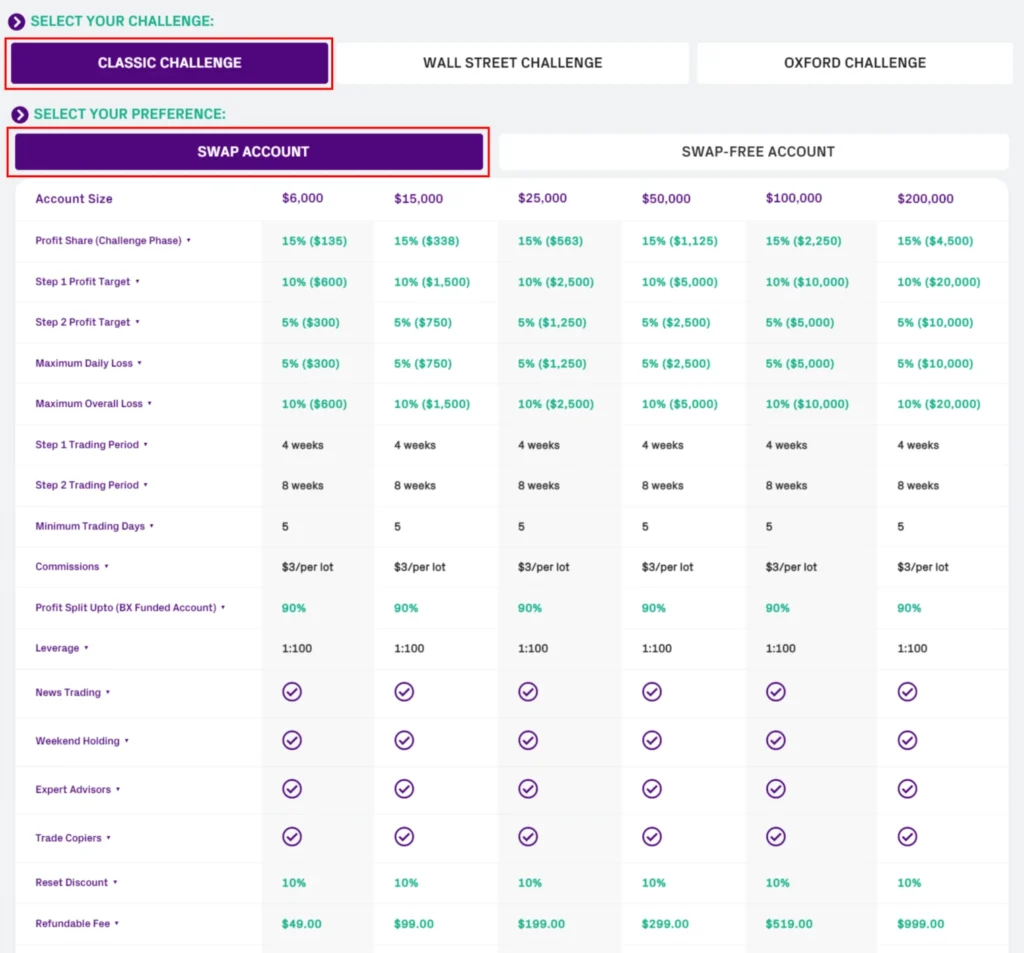

Classic Challenge at Funded Prop BX

The Classic Challenge from Funded Prop BX is designed to offer traders the chance to handle substantial trading capital through a structured two-step evaluation process. Each step has predefined profit targets and loss limits, and is accessible in both swap and swap-free formats.

Challenge Details

Account Sizes and Fees:

- Options range from $6,000 to $200,000, catering to various levels of trading experience and risk management capacity.

Profit and Loss Parameters:

- Step 1 Profit Target: Requires a 10% increase in the initial account balance.

- Step 2 Profit Target: Sets a more conservative goal of a 5% increase following Step 1.

- Maximum Daily Loss: Restricted to 5%.

- Maximum Overall Loss: Capped at 10%.

Trading Period and Requirements:

- Step 1 Trading Period: Limited to 4 weeks to achieve the initial profit target.

- Step 2 Trading Period: Extended to 8 weeks.

- Minimum Trading Days: Mandates trading on at least 5 days to promote consistent market engagement.

Additional Conditions:

- Commissions: Set at a flat rate of $3 per lot.

- Leverage: Allows up to 1:100.

- Profit Split: Traders can receive up to 90% of the profits in the funded account phase.

- Trading Features: Supports news trading, weekend holding, and the use of expert advisors and trade copiers.

- Reset Discount: Provides a 10% reduction in fees for those needing to reset the challenge.

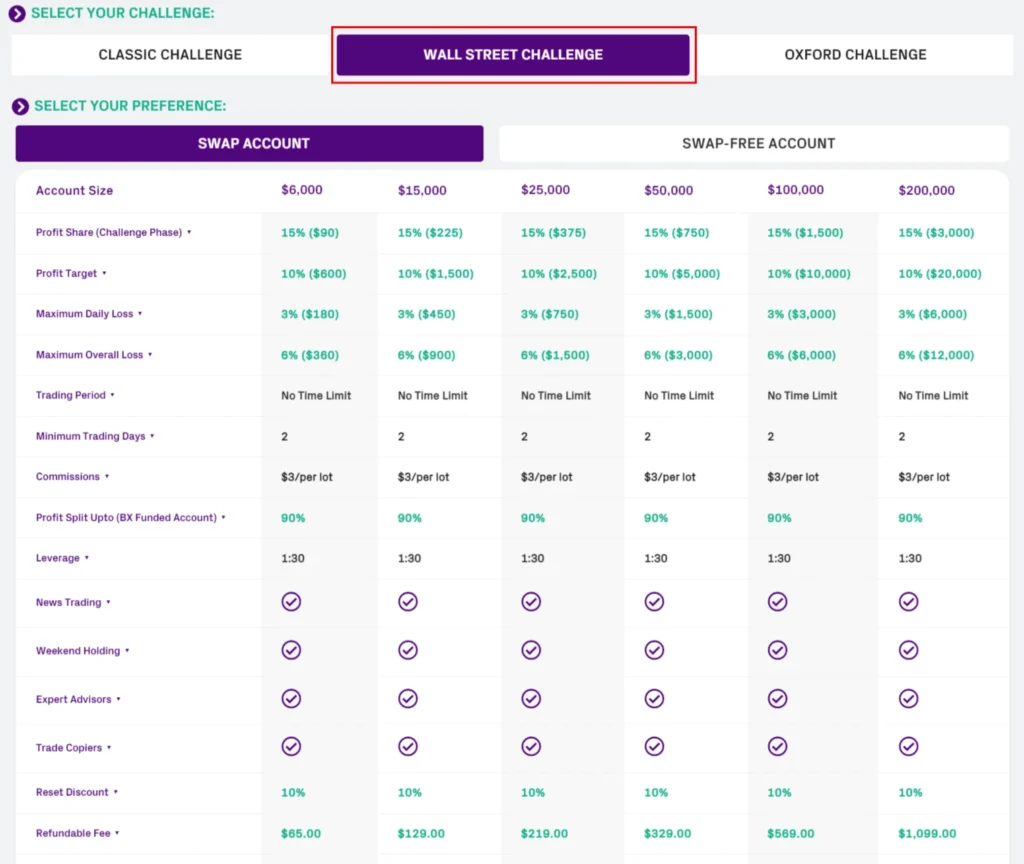

Wall Street Challenge at Funded Prop BX

The Wall Street Challenge, offered by Funded Prop BX, mirrors the intense trading pressures of Wall Street through a singular evaluation phase. It aims to measure a trader’s prowess in managing considerable risk and securing profits under strict conditions. Both swap and swap-free account options are available for participants.

Challenge Details

Account Options and Sizes:

Traders can choose from accounts sized between $6,000 and $200,000, tailored to accommodate different levels of trading experience and risk preferences.

Profit and Loss Parameters:

- Profit Target: Set at 10%.

- Maximum Daily Loss: Capped at 3% of the account balance.

- Maximum Overall Loss: Restricted to 6%.

Trading Terms:

- Trading Period: No time limit.

- Minimum Trading Days: Requires trading activity for at least 2 days to confirm market engagement.

Additional Conditions:

- Commissions: Trades incur a standard fee of $3 per lot.

- Leverage: Set at 1:30.

- Profit Split: In the funded phase, traders can earn up to 90% of the profits.

- Trading Flexibility: Supports news trading, weekend holding, and using expert advisors and trade copiers.

- Reset Discount: A 10% discount is available for traders who need to restart the challenge.

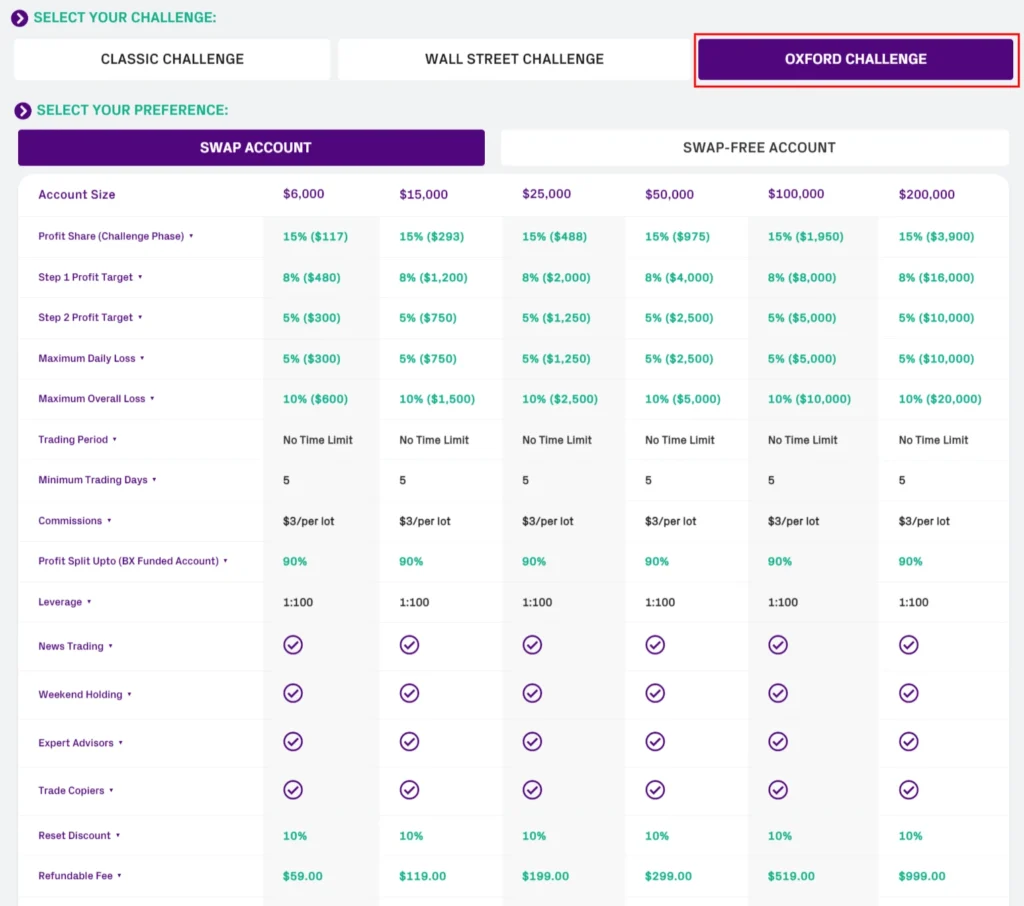

Oxford Challenge at Funded Prop BX

The Oxford Challenge, presented by Funded Prop BX, evaluates traders on their ability to manage substantial capital and adhere to strict trading guidelines. Traders can participate in swap or swap-free formats, advancing through two profit-target stages.

Challenge Details

Account Sizes:

Traders can select from accounts ranging between $6,000 and $200,000, based on their risk tolerance and capability.

Profit Targets and Loss Limits:

- Step 1 Profit Target: Achieve 8% of the initial account balance.

- Step 2 Profit Target: Requires a 5% gain on the increased balance after completing Step 1.

- Maximum Daily Loss: Limited to 5% of the account balance.

- Maximum Overall Loss: Restricted to 10% of the initial balance.

Trading Flexibility and Periods:

- Trading Period: Unlimited, allowing traders to achieve targets at their own pace.

- Minimum Trading Days: Requires at least 5 days of trading to ensure sufficient market participation.

Fees and Profit Sharing:

- Commissions: A flat rate of $3 per lot traded.

- Profit Split: Up to 90%.

Leverage and Trading Features:

- Leverage: Up to 1:100.

- Trading Features: Includes support for news trading, weekend holding, and the use of expert advisors and trade copiers.

Additional Features:

- Reset Discount: Offers a 10% discount for traders who need to reset their challenge.

Trading Platforms

Funded Prop BX provides a range of trading platforms to meet diverse technological and trading preferences. These platforms support various trading styles, order types, and access needs.

Baxia MetaTrader 5

- This platform offers advanced charting tools, technical indicators, and market analysis capabilities. It accommodates all trading order types and is known for its comprehensive functionality.

Baxia MetaTrader 5 MacOS

- Tailored for MacOS users, this version of MetaTrader 5 ensures compatibility and full functionality for traders on Apple devices, maintaining strong performance and feature availability.

Baxia WebTrader

- Baxia WebTrader is a web-based platform that allows traders to access their accounts from any web browser, eliminating the need for downloads or installations. It suits traders who need simplicity and flexibility, particularly those using multiple devices.

Baxia Mobile Trading App

- The mobile app is designed for traders who need to access their accounts while away from traditional desktop environments. It provides key trading functions, real-time market data, and analysis tools on smartphones or tablets.

Each of these platforms from Funded Prop BX is equipped to meet a wide range of trading needs, allowing traders to select the option that best fits their specific requirements and lifestyle.

Educational and Support Services

Funded Prop BX provides a comprehensive set of tools and resources designed to assist traders at all levels, from beginners to advanced. These educational and analytical tools are aimed at enhancing trading knowledge and capabilities.

- Forex Full Course: This free course is tailored for beginners and offers a structured introduction to forex trading. It covers basic to advanced trading concepts, helping new traders develop a solid foundation in forex market dynamics.

- Forex Calculators: A suite of calculators is available to help traders evaluate risk, monitor profit or loss for each trade, and estimate trading costs. These tools are essential for effective trade management and financial planning.

- Economic Calendar: Traders can follow high-impact news and events that affect the financial markets. This calendar includes updates on the latest economic data, helping traders anticipate market movements based on economic releases.

- Market Research: The Baxia Analyst team provides ongoing fundamental and technical analysis, offering insights that can help traders make informed decisions. This resource is valuable for staying updated with the latest market trends and developments.

- Education Center: This resource offers a collection of educational materials that cover various aspects of trading, including strategies, market analysis, and risk management. These resources are geared towards helping traders enhance their trading skills and profitability.

- Help Center: Traders can access a comprehensive FAQ section that addresses common questions and topics related to trading with Funded Prop BX. This center is a valuable resource for resolving queries and enhancing understanding of the trading platform and processes.

These tools and resources provided by Funded Prop BX, in collaboration with Baxia, are designed to support traders in refining their trading techniques and enhancing their market knowledge, ultimately aiding in their trading journey.

Trustpilot Reviews for Baxia Markets*

Baxia Markets has garnered a strong reputation on Trustpilot, achieving an “Excellent” rating with a score of 4.8 out of 5 based on 270 reviews. This high rating reflects a significant level of customer satisfaction and trust in their services. However, this is the Trustpilot of Baxia Markets and not specifically Baxia Prop BX.

*The Trustpilot shown on the homepage of Baxia Prop BX is the Trustpilot of Baxia Markets. Just keep that in mind.

Overview of Customer Feedback

- Positive Reviews: The majority of the reviewers praise Baxia Markets for its reliable trading execution, customer support, and user-friendly trading conditions. Many traders have highlighted the swift execution during news events and the stability of the platform, even during volatile market conditions. The prompt and helpful customer service has also received commendations.

- Critical Reviews: A smaller portion of the feedback includes some criticisms, primarily regarding delays or lack of communication from the support team concerning account leverage adjustments. These issues seem to be isolated incidents, as the company has responded promptly to complaints, showing a commitment to resolving any client concerns.

- Customer Engagement: Baxia Markets is active in responding to both positive and negative reviews, indicating a proactive approach to customer service. They seem committed to improving their services and addressing any trader concerns swiftly.

This overall positive feedback on Trustpilot suggests that Baxia Markets is a reliable choice for traders looking for a competent and customer-focused broker. However, as with any service, potential users are encouraged to consider the full spectrum of reviews to make an informed decision.