PipFarm is a Singapore-based prop firm that offers 1 step evaluation and funding to prop traders. The firm presents a unique proposition with its simple evaluation process and lucrative funding opportunities, aiming to empower traders to reach significant trading capital.

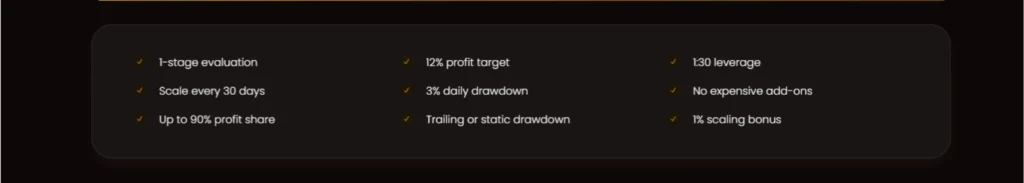

Key Features and Offerings:

- Funded Trader Program: Traders can start with as little as $5,000 in seed funding and qualify for up to $100,000 through successful trading evaluations. The profit target is set at 12%, and traders can scale their funding every 30 days.

- Trading Conditions:

- Drawdown: Offers a choice between 6% static or 12% trailing drawdown.

- Daily Loss Limit: Set at 3% based on the end-of-day balance.

- Leverage: Maximum leverage is 1:30, with variable options depending on the product.

- Scaling Program: Provides incremental funding increases of 50%, with the potential to manage up to $500,000.

- Platform and Strategy: PipFarm utilizes the cTrader platform, allowing traders to employ any trading strategy without restrictions on style. The use of cTrader bots is allowed if the same bot was utilized to pass the screening test; trading via FIX API or cTrader OpenAPI is also permitted, except for high-frequency trading.

- Profit Share: Up to 90% profit share with scaling bonuses for consistent performance. Traders can request their first profit share after three trading days, with subsequent requests every 14 days, subject to account conditions.

- News and Weekend Trading: Trading during news releases and over weekends is permitted.

- Stop Loss Requirement: Mandatory use of a stop loss continues until a trader reaches Rank 1, after which it becomes optional.

Evaluation and Scaling:

PipFarm streamlines its approach for proprietary trading firm accounts, focusing on an efficient evaluation process that allows traders to manage significant trading funds.

- Evaluation Process: Traders undergo a one-stage evaluation to qualify for funding, which requires them to meet a specific profit target while adhering to drawdown limits.

- Scaling Opportunities: Successful traders can access additional funding every 30 days after passing the initial evaluation, supporting long-term growth and enhanced funding potential.

Screening and Evaluation Process

- Screening Test: PipFarm conducts a preliminary test to assess a trader’s strategy, risk management, and trading style. This ensures traders are capable of responsibly managing the allocated capital.

- One-Stage Process: In contrast to multi-stage evaluations typical at other firms, PipFarm employs a single-stage process, simplifying the pathway to funding.

- Test Outcome: Traders who exceed daily loss limits or the maximum trailing loss are disqualified but may retake the test as needed.

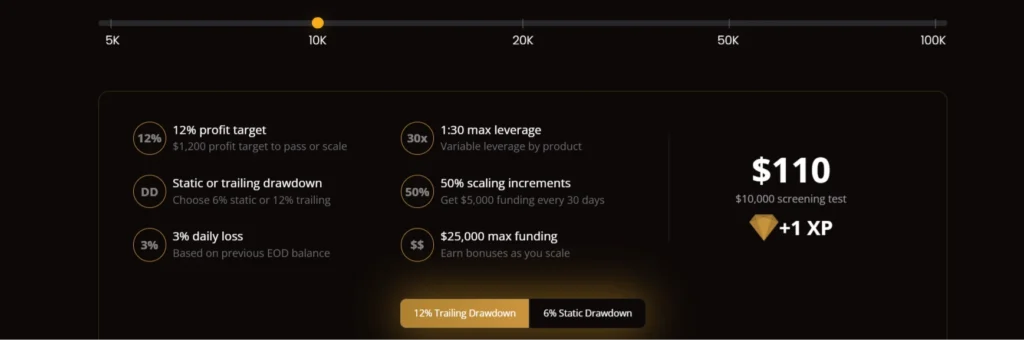

- Cost of the Test: The screening test costs about 1% of the seed capital to be allocated upon passing. For example, a test for a potential $10,000 fund costs $110.

Passing the Screening Test

- Profit Target: Traders must achieve a 12% profit to pass. For a $10,000 starting balance, this means reaching at least $11,200.

- Automatic Qualification: Traders automatically pass the assessment once their account balance exceeds the 12% profit target, provided all positions are closed at the time of assessment.

This structure focuses on achieving clear profit targets without the complexity of multiple evaluation stages, reflecting PipFarm’s commitment to providing straightforward and effective paths to trading funding.

Here’s a detailed example of how the $10K account at PipFarm works, tailored for traders aiming to qualify for up to $100,000 in funding.

$10K Account at PipFarm

Initial Setup and Goals

- Evaluation Funding: Start with a $10,000 evaluation account by passing PipFarm’s trading evaluation.

- Profit Target: Achieve a 12% profit, equating to $1,200, to pass the evaluation or qualify for scaling.

- Drawdown Options: Choose between a 6% static drawdown or a 12% trailing drawdown.

- Daily Loss Limit: Maintain within a 3% daily loss limit, calculated based on the previous end-of-day (EOD) balance.

- Leverage: Utilize a maximum leverage of 1:30, which may vary depending on the traded product.

Scaling and Advancement

- Scaling Increments: Once you meet the initial profit target and continue trading successfully, you qualify for a 50% increase in funding every 30 days. For the $10K account, this means an additional $5,000 funding per scaling period.

- Maximum Funding: Through successful scaling, you can grow your initial $10K account up to a maximum of $25,000. Bonuses may be awarded as you scale up your account.

Cost and Additional Details

- Screening Test Fee: There is a $110 fee for the screening test to access the $10K account.

- Drawdown Details: The 12% trailing drawdown allows more flexibility as it adjusts with your account’s highest balance, whereas the 6% static drawdown is fixed and does not change.

- Experience Points: Gain +1 XP for your trading profile, enhancing your capabilities and recognition within the trading community.

Example Scenario

- Start with $10,000 and aim to make $1,200 profit.

- If successful, apply for an additional $5,000 funding after 30 days.

- Continue to grow your funding up to $25,000 while managing drawdowns and leveraging appropriately.

This account structure is designed to help traders methodically increase their trading capital through consistent performance and adherence to risk management protocols.

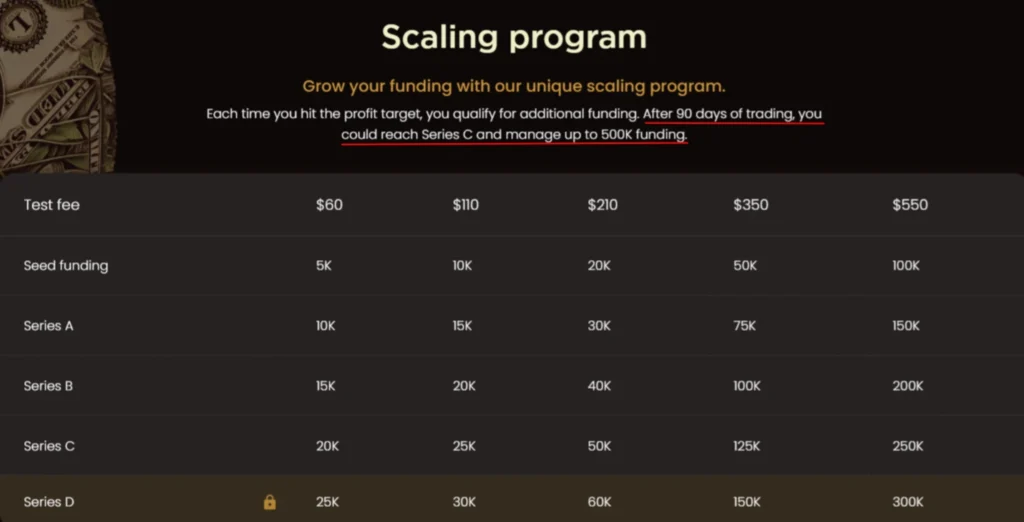

Scaling Program

The program starts with an initial seed funding, which traders can increase through successive trading series by hitting set profit targets. Each series represents a stage where the trader can qualify for additional funding after achieving the necessary profit.

Program Structure

- Initial Seed Funding: Traders begin with a seed funding amount ranging from $5K to $100K, depending on the test fee paid. The fees and corresponding initial capital are as follows:

- $60 fee for $5K

- $110 fee for $10K

- $210 fee for $20K

- $350 fee for $50K

- $550 fee for $100K

- Series Progression:

- Series A: After meeting the initial profit targets, traders can elevate their funding up to Series A levels, which range from $10K to $150K.

- Series B: Continued success leads to Series B, with potential funding from $15K to $200K.

- Series C: Achieving further targets, traders can reach Series C within 90 days of trading, managing up to $250K.

- Series D: The final series in this progression allows traders to manage up to $300K.

Advancement Criteria

- Profit Targets: To advance to the next series, traders must hit specified profit targets established for each level.

- Time Frame: Advancement to Series C, where a trader can manage up to $250K, is possible within 90 days of consistent trading success.

This structured program enables traders to systematically grow their managed capital by demonstrating skill and consistency in achieving profit goals over time.

Payout Process

The payout process at this firm allows traders to retain a significant portion of the profits they earn, with the potential to keep up to 90% of the profits.

How It Works

- Base Profit Share: Traders start with a base profit share of 70%. This means that initially, traders keep 70% of the profits they earn from their trading activities.

- Incremental Increases: The profit share percentage increases based on the amount of profits withdrawn from the account. Specifically:

- For every 3% of the account balance that a trader withdraws as profit, their share of future profits increases by 5%.

- Maximum Profit Share: This increment continues until the profit share reaches 90%. At this maximum rate, the trader keeps 90% of all profits earned.

Example

- If a trader starts with a $10,000 account and makes enough profit to withdraw $300 (which is 3% of the account), their profit share will increase from 70% to 75% for subsequent earnings.

- As the trader continues to withdraw profits in increments of 3% of the account balance, their share increases by another 5% each time, potentially reaching up to 90%.

This structured profit-sharing arrangement incentivizes traders to successfully trade and withdraw profits, as doing so increases their share of future profits.

Unique Features:

- Power-Ups: Traders can unlock special features and benefits as they progress, enhancing their trading capabilities and rewards.

- Dynamic Leverage: Leverage adjustments are made based on trading performance and market conditions, promoting responsible trading.

Before we delve into the details of dynamic leverage, let’s first discuss the Power-Up rewards system at PipFarm. This unique feature plays a crucial role in enhancing traders’ capabilities and optimizing their trading strategies. Through the Power-Up system, traders can unlock various benefits that significantly impact their trading conditions and financial outcomes. Understanding these rewards will provide a solid foundation for appreciating the subsequent discussion on dynamic leverage and its implications for traders at PipFarm.

Power-Ups at PipFarm

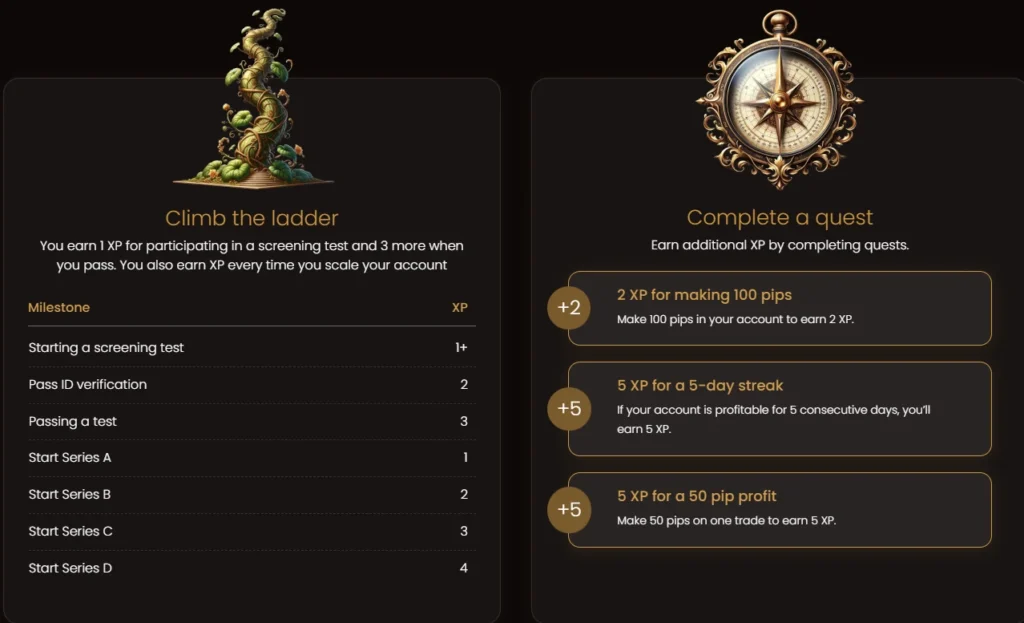

PipFarm features a distinctive rewards system called “Power-Ups,” which traders unlock by earning Experience Pips (XP) through their trading progress. These Power-Ups enhance trading capabilities and offer tangible benefits as traders reach specific milestones.

Earning and Using XP

- Earning XP: Traders gain XP by engaging with the PipFarm trading program, completing quests, and reaching key trading milestones such as passing evaluations or scaling their accounts.

- Using XP: Traders use accumulated XP to unlock different ranks, each providing specific benefits to improve their trading conditions or financial outcomes.

Key Power-Up Features

- Rank Advancements: Advancing through ranks offers distinct advantages:

- Rank 1 – No Stop Loss Requirement: Allows trading without mandatory stop-loss orders, giving more control over risk management.

- Rank 2 – Extended Grace Periods: Doubles the inactivity period before penalties, offering increased flexibility.

- Rank 3 – Free VPS with Trade Copier: Provides a Virtual Private Server to enhance trading execution reliability.

- Rank 4 – Reduced Commissions: Halves trading commissions to lower trading costs.

- Rank 5 – Increased Leverage: Boosts leverage from 1:30 to 1:50, increasing trade exposure.

- Rank 6 – Any Time Payouts: Enables 24-hour withdrawals, improving liquidity access.

- Rank 7 – Increased Daily Loss Allowance: Increases the daily loss limit to 5%, offering a wider buffer for trading strategies.

- Rank 8 – Capital Boost: Adds an extra 10% capital at each funding stage.

- Rank 9 – Accelerated Funding: Shortens the interval for scaling funding, accelerating capital growth.

- Rank 10 – Free 100K Test Account: Grants a significant increase in test account funds at no extra cost.

Additional Features

- Quests for XP: Traders can earn additional XP through specific quests, like achieving a set number of pips over consecutive days.

- Power-Up Combinations: Certain power-ups cannot be combined, ensuring traders utilize the most beneficial features for their strategies.

This rewards system not only incentivizes traders to enhance their performance by linking trading success to tangible rewards but also allows them to customize their trading environment to better match their strategies and risk preferences.

Dynamic Leverage at PipFarm

PipFarm employs a dynamic leverage system that adjusts based on a trader’s net exposure to each trading instrument, effectively balancing risk management with trading flexibility.

How Dynamic Leverage Works

- Leverage Adjustment: As exposure to a specific trading instrument increases, PipFarm dynamically increases the margin requirements, which effectively reduces the leverage.

- Application by Symbol: Dynamic leverage settings are applied individually for each trading symbol and are categorized by asset class. As a result, leverage can vary not only between different asset types, such as forex and commodities, but also between different instruments within the same asset class.

- Default and Enhanced Rates: Initially, traders are provided with a default leverage rate. However, those who achieve higher leverage through the PipFarm Power-Up rewards system can access enhanced leverage rates.

Purpose of Dynamic Leverage

- Risk Management: The adjustment of leverage based on exposure helps traders manage risk more effectively. Increased exposure leads to stricter margin requirements, which can help mitigate excessive losses and maintain account stability.

- Trading Flexibility: Despite the limits imposed by dynamic leverage, PipFarm ensures flexibility for traders. Those with proven track records and specific power-ups can access higher leverage, allowing them to amplify their trading strategies while managing risk.

This dynamic leverage system is integral to PipFarm’s strategy of merging trading flexibility with robust risk controls, supporting traders in navigating their trading activities more efficiently.

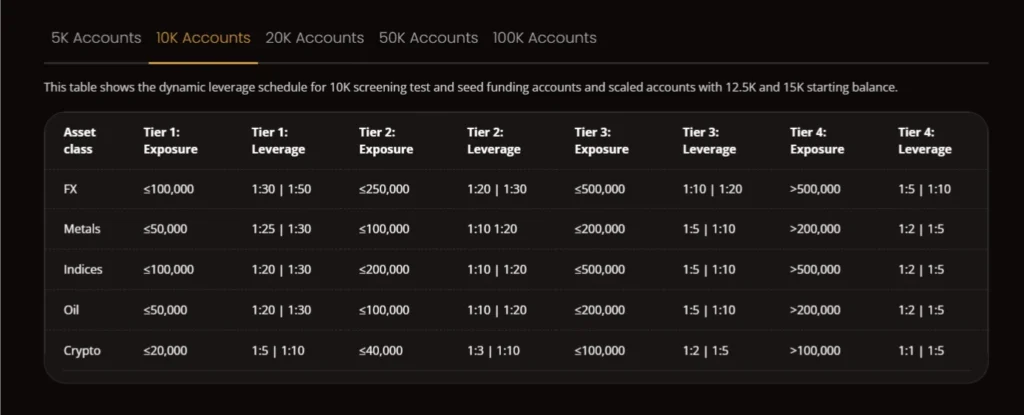

Example of Dynamic Leverage at PipFarm

To illustrate how dynamic leverage works at PipFarm, let’s consider a trader using a $10K screening test and seed funding account or scaled accounts starting with $12.5K and $15K. We’ll look at how leverage adjusts across different asset classes as the trader’s exposure increases.

Dynamic Leverage Schedule

Here’s how leverage adjusts based on a trader’s exposure within various asset classes:

1. Foreign Exchange (FX):

- Tier 1: For exposure up to $100,000, leverage ranges from 1:30 to 1:50.

- Tier 2: For exposure up to $250,000, leverage decreases to 1:20 to 1:30.

- Tier 3: For exposure up to $500,000, leverage further reduces to 1:10 to 1:20.

- Tier 4: For exposure above $500,000, leverage drops to 1:5 to 1:10.

2. Metals:

- Tier 1: For exposure up to $50,000, leverage ranges from 1:25 to 1:30.

- Tier 2: For exposure up to $100,000, leverage is 1:10 to 1:20.

- Tier 3: For exposure up to $200,000, leverage decreases to 1:5 to 1:10.

- Tier 4: For exposure above $200,000, leverage is 1:2 to 1:5.

3. Indices:

- Tier 1: For exposure up to $100,000, leverage ranges from 1:20 to 1:30.

- Tier 2: For exposure up to $200,000, leverage is 1:10 to 1:20.

- Tier 3: For exposure up to $500,000, leverage decreases to 1:5 to 1:10.

- Tier 4: For exposure above $500,000, leverage is 1:2 to 1:5.

4. Oil:

- Tier 1: For exposure up to $50,000, leverage ranges from 1:20 to 1:30.

- Tier 2: For exposure up to $100,000, leverage is 1:10 to 1:20.

- Tier 3: For exposure up to $200,000, leverage decreases to 1:5 to 1:10.

- Tier 4: For exposure above $200,000, leverage is 1:2 to 1:5.

5. Cryptocurrencies:

- Tier 1: For exposure up to $20,000, leverage ranges from 1:5 to 1:10.

- Tier 2: For exposure up to $40,000, leverage is 1:3 to 1:10.

- Tier 3: For exposure up to $100,000, leverage decreases to 1:2 to 1:5.

- Tier 4: For exposure above $100,000, leverage is 1:1 to 1:5.

Impact of Dynamic Leverage

This dynamic leverage structure allows PipFarm to balance risk management by adjusting leverage based on the level of exposure a trader has in a particular asset class. As exposure increases, leverage is progressively reduced, helping to manage potential risks associated with larger positions. This system ensures that traders can pursue various trading strategies while maintaining a manageable risk profile, especially in volatile or less liquid markets.

About PipFarm

Now let’s explore PipFarm in greater detail to better understand this proprietary trading firm you may be considering for your trading career. Building trust and obtaining a thorough grasp of the firm’s leadership, mission, and compliance with regulations are essential in the intricate world of financial markets. Gaining insight into PipFarm’s background and operational principles will assist you in determining if it aligns with your trading objectives and values.

About the CEO: James Glyde

James Glyde is the Chief Executive Officer at PipFarm, bringing over a decade of experience in the online trading industry to his role. His expertise was particularly sharpened at cTrader, where he was instrumental in product development and corporate governance. Glyde’s extensive career also includes pivotal roles at established brokers and proprietary trading firms, such as TopFX, Scandinavian Markets, and Nordic Funder. His vast experience is crucial in steering PipFarm towards innovative trading solutions and operational excellence.

Company Mission and Approach

PipFarm is dedicated to empowering traders by providing them with essential tools and a platform that supports the evaluation and enhancement of their trading strategies through virtual accounts. The firm has independently developed its dashboard and risk management systems, featuring a unique experience-based progression system that delivers enduring benefits to its trading community.

Compliance and Ethical Considerations

While operating in a sector not specifically regulated under the Singapore Securities and Futures Act 2001, PipFarm is committed to complying with significant consumer protection regulations, including the Singapore Consumer Protection (Fair Trading) Act. This commitment helps ensure that PipFarm upholds fair practices and protects the interests of its traders.

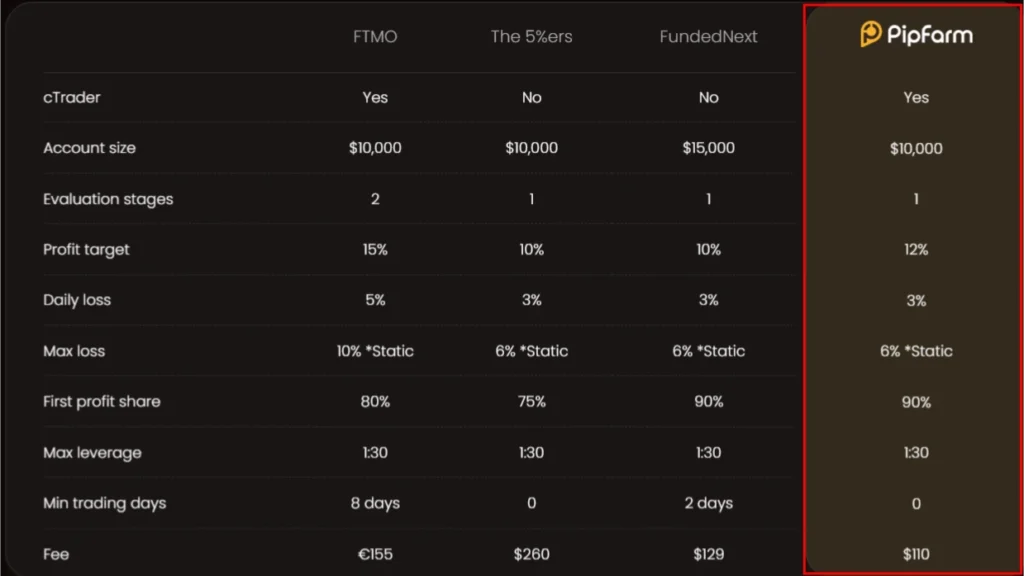

Competitor Comparison:

PipFarm positions itself competitively against other prop firms like FTMO, The 5%ers, and FundedNext, with favorable conditions such as lower commission rates and a user-friendly interface highlighted in testimonials.

PipFarm’s approach is designed to attract both novice and experienced traders by offering straightforward, scalable funding solutions coupled with competitive trading conditions and a focus on trader education and development.

Trustpilot Reviews for PipFarm

PipFarm enjoys a “Great” rating of 4.2 out of 5 stars on Trustpilot, based on feedback from 7 customers. As a newer proprietary trading firm, the small number of reviews on Trustpilot is understandable. Yet, the feedback is uniformly positive, which speaks well of the firm’s reputation and quality of operations. Here’s a closer look at the Trustpilot reviews:

Positive Feedback Highlights:

- Responsive Leadership: Reviewers frequently commend the CEO’s responsiveness, particularly noting his active engagement on the firm’s Discord channel and his dedication to enhancing trading conditions for users.

- Advanced Trading Technology: Users have highlighted PipFarm’s use of advanced technology, especially their implementation of the cTrader platform, known for its robust features and user-friendly interface.

- Brand Appreciation: The branding and professional demeanor of PipFarm have been well-received, with traders expressing satisfaction with both the visual and functional elements of the service.

Specific Praise:

- Trading Capital Opportunities: A user noted the significant capital allocation of $50,000, appreciating PipFarm’s trust in providing opportunities to manage substantial funds.

- Recommendations: Users have recommended the platform, praising its blend of cutting-edge technology and informed leadership, which distinguishes it from many other new trading platforms.

Although the reviews are overwhelmingly positive, potential traders should bear in mind that the review count is still quite limited. As with any financial service, it’s prudent to continue gathering information and consider a broader array of reviews and sources to obtain a well-rounded perspective on the firm’s reliability and service quality.