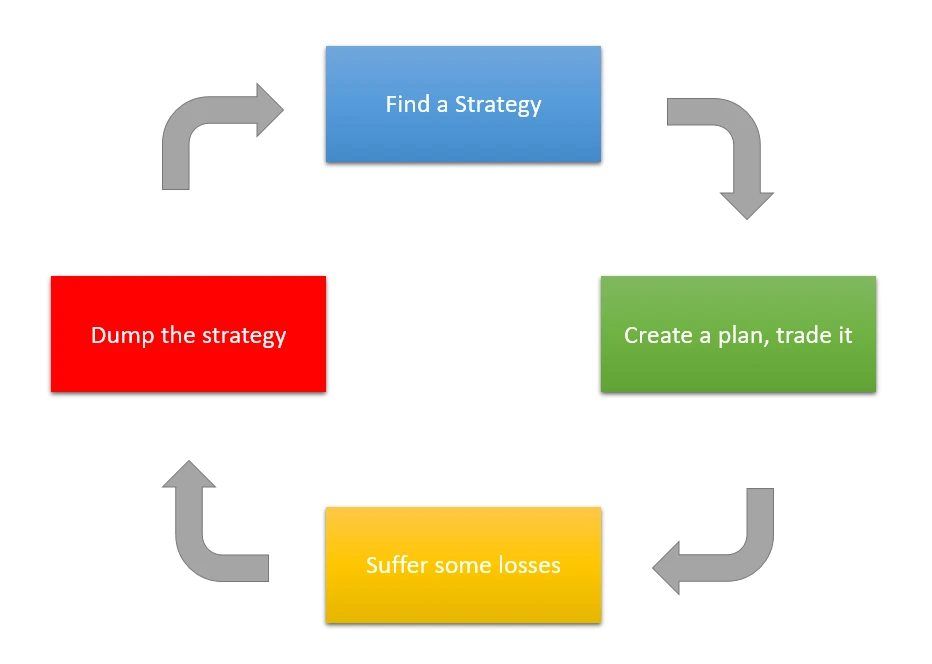

The Cycle of Doom

If you’re a novice trader, you’ve probably heard the term psychological trading trap “cycle of doom” thrown around in trading circles. This concept is not just a buzzword but a real phenomenon that affects the majority of traders. It’s a vicious cycle that can trap even the most seasoned traders, leading them down a path of poor decisions, losses, and eventually, a dwindling trading account. This article aims to break down this complex subject into easy-to-understand frameworks and provide actionable insights to help you navigate this treacherous terrain.

The Cycle of Doom: What Is It?

The cycle of doom is a psychological trap that traders often fall into, and it consists of three main phases:

- The Search: This is where traders look for a trading strategy that promises high returns. Whether it’s through friends, YouTube videos, or articles on platforms like TradingView, traders are always in search of the “Holy Grail” of trading strategies. According to Investopedia, herd behavior often leads traders to make impulsive decisions, contributing to the cycle of doom.

- The Action: Once a strategy is chosen, traders are quick to implement it, often without proper backtesting or evidence to support its effectiveness. This phase is driven by greed and the desire for quick profits.

- The Blame: When the strategy inevitably fails, traders enter the blame phase. Here, they lose confidence in their chosen system and start looking for a new one, thus completing the cycle.

Why Do Traders Fall Into This Trap?

The cycle of doom is not just a random occurrence but a result of specific emotional and psychological factors. According to ForexSignals, traders often suffer from a lack of proper strategy and unrealistic expectations, which leads them into this dangerous cycle. Over-leveraging and taking unnecessary risks are also common reasons why traders find themselves stuck in this loop.

How to Break Free From the Cycle of Doom

Modification and Trust

The first step to breaking free is to modify your trading strategy according to market conditions and your trading style. For instance, if you’re using Elliott wave theory as your primary trading strategy, you might want to incorporate price action as a confirmation tool. Trusting your modified system is crucial for long-term success.

Backtesting: The Holy Grail

Before implementing any trading strategy, it’s essential to backtest it rigorously. This will give you a clear idea of how the strategy performs under different market conditions and help you make informed decisions.

Risk Management

Risk management is the cornerstone of any successful trading career. Always ensure that your trading system provides adequate returns for the level of risk you’re willing to take. Without proper risk management, you’re essentially gambling your money away.

Conclusion

The psychological trading trap known as the cycle of doom is a real and present danger for traders, especially those who are new to the game. However, understanding its components and the psychology behind it can help you avoid falling into this trap. Remember, the key to a successful trading career is a well-thought-out strategy, rigorous backtesting, and effective risk management.