How Inexperience Causes Massive Losses in the Forex Markets

Welcome to this comprehensive guide on how inexperience causes massive losses in the Forex markets. If you’re new to Forex trading or even if you’ve been around for a while but are looking to sharpen your skills, you’re in the right place.

Brief Overview of the Forex Market and Its Inherent Risks

The Forex market is the world’s largest financial market, with a daily trading volume exceeding $6 trillion. It’s a decentralized market where currencies are traded across the globe. While the market offers significant opportunities for profit, it’s also fraught with risks. Market volatility, leverage, and even geopolitical events can impact currency values in the blink of an eye.

The Forex market is not for the faint of heart. It offers high rewards but comes with equally high risks.

The Role of Experience in Trading Success

Experience is the cornerstone of success in any field, and Forex trading is no exception. The more you trade, the more you learn—about the market, about your own trading habits, and about the emotional discipline required to be a successful trader.

The Purpose of the Article

The aim of this article is to delve deep into how a lack of experience can be a major stumbling block for traders in the Forex market. We’ll explore common mistakes, the importance of proper risk management, and much more.

Importance of Experience in Forex Trading

Why Experience is Crucial in Forex Trading

Experience in Forex trading is like the compass you need in a vast ocean. It helps you navigate market trends, understand trading signals, and, most importantly, make informed decisions. An experienced trader knows when to enter or exit a trade, how to manage risks, and how to maximize profits.

The Learning Curve Involved in Becoming a Successful Trader

Forex trading has a steep learning curve. Beginners often find themselves overwhelmed by jargon, complex charts, and the fast-paced nature of the market. However, as you gain experience, these challenges become stepping stones. You learn to interpret data, understand market psychology, and develop your own trading strategies.

High Failure Rate Among Inexperienced Traders

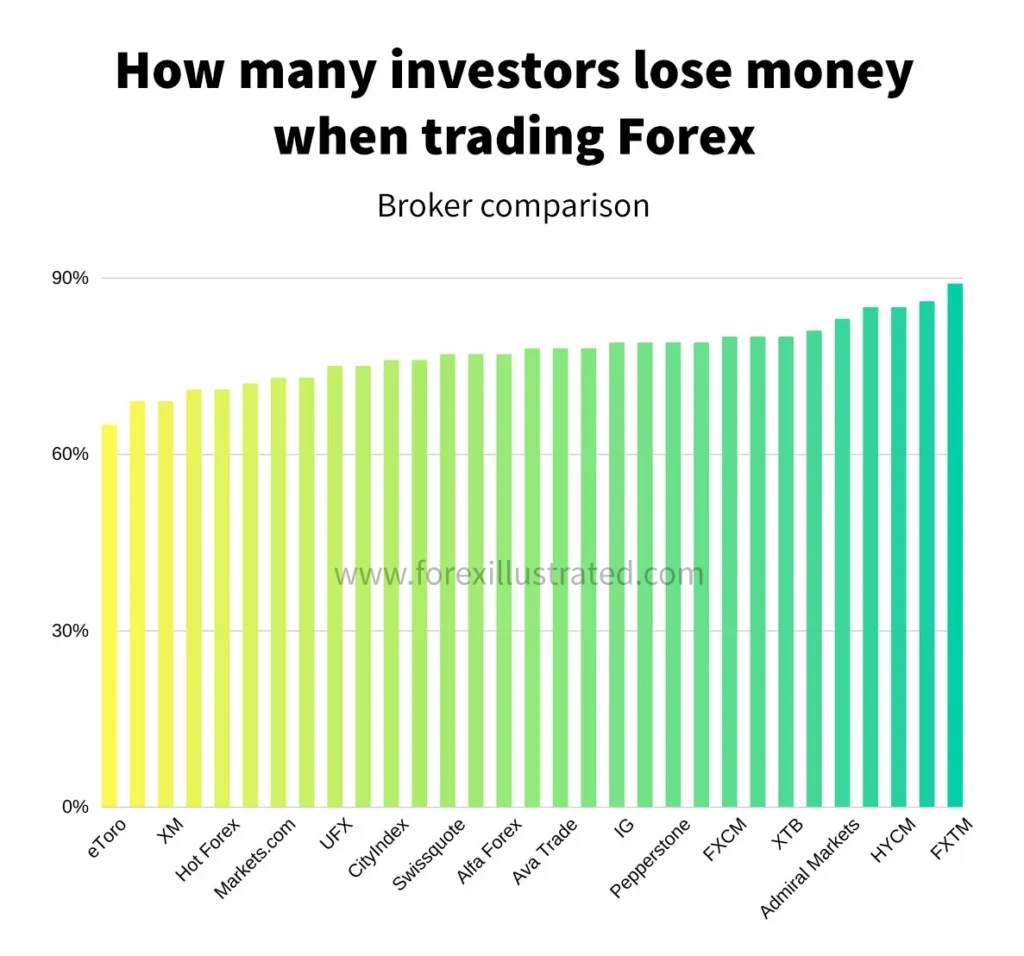

Statistics on Failure Rates

It’s a sobering fact that up to 89% of new Forex traders lose money and quit within their first year of trading. This high failure rate is often attributed to a lack of experience and understanding of the market dynamics. This is how inexperience causes massive losses in the forex markets.

The statistics are harsh but true. A majority of new traders fail because they jump into the Forex market without adequate knowledge or experience.

Here is another data from Traderslog.com. This data shows up to 86% of traders lose money.

Common Pitfalls That Lead to Failure

Inexperienced traders often fall into several traps. These include overtrading, poor risk management, and emotional decision-making. Each of these mistakes can be costly, but when combined, they can be disastrous.

The Danger of Expecting Quick Profits

The Misconception of Quick Riches in Forex Trading

One of the most alluring aspects of Forex trading is the prospect of quick profits. Many newcomers are drawn to stories of traders turning small accounts into fortunes overnight. However, these stories are often the exception, not the rule. The reality is that Forex trading is a long-term game that requires skill, discipline, and a solid understanding of the market.

Realistic vs. Unrealistic Expectations

Setting realistic expectations is crucial for long-term success in Forex trading. While it’s natural to aim for high returns, it’s essential to understand that high rewards come with high risks. Aiming for a steady growth rate is more sustainable and less likely to result in significant losses.

Incomplete Understanding of Currency Movements

The Complexities of Currency Pairs and Market Conditions

Forex trading isn’t just about buying low and selling high. It involves understanding the complexities of currency pairs, market conditions, and even geopolitical events. Each currency pair has its own set of factors that drive its value, and understanding these can be the difference between making a profit and suffering a loss.

The Importance of Understanding Economic Indicators

Economic indicators like GDP growth rates, interest rates, and employment figures play a significant role in currency valuation. A trader who ignores these indicators is essentially trading blind. Understanding how to interpret this data can give you a significant edge in the market.

Ignorance As a Major Cause of Losses

How Lack of Knowledge Can Be Detrimental

Ignorance is not bliss when it comes to Forex trading. A lack of knowledge about the market, trading principles, and risk management can lead to disastrous outcomes. In the worst-case scenario, you could lose your entire trading capital.

Ignorance is one of the most expensive commodities when it comes to Forex trading.

The Dangers of Trading Without Proper Education

Trading without a proper understanding of the market is like driving without a license—you’re bound to run into trouble. Education is the foundation of successful trading. Without it, you’re setting yourself up for failure.

Lack of Information

The Role of Up-to-Date Information in Trading Decisions

In the fast-paced world of Forex trading, information is currency. Having access to real-time data, news, and market analysis can make the difference between a profitable trade and a losing one. Up-to-date information allows you to react quickly to market changes, giving you an edge over traders who are working with outdated or incomplete data.

Where to Find Reliable Information

Not all information is created equal. It’s crucial to rely on reputable sources for your market news and analysis. Financial news websites, trusted Forex forums like Forex Factory, and professional analysts are good places to start. Many traders also use trading platforms that offer real-time news feeds and analysis tools.

Lack of Expertise

The Importance of Specialized Knowledge in Forex Trading

Forex trading is a specialized skill that requires a deep understanding of market mechanics, risk management, and trading strategies. Without this specialized knowledge, you’re at a significant disadvantage and are more likely to make costly mistakes.

How to Gain Expertise Through Continuous Learning

The road to Forex expertise is paved with continuous learning. This can include reading books, taking online courses, and even seeking mentorship from experienced traders. The more you learn, the more tools you’ll have in your trading toolbox.

Importance of Analysis in Forex Trading

Types of Analysis: Fundamental, Technical, and Sentimental

Successful Forex trading involves a combination of different types of analysis. Fundamental analysis involves studying economic indicators and geopolitical events. Technical analysis focuses on chart patterns and indicators. Sentimental analysis gauges market sentiment based on news, reports, and other media.

A well-rounded trader is skilled in fundamental, technical, and sentimental analysis. Each provides a unique lens to view the market.

How Proper Analysis Can Prevent Losses

Proper market analysis is your best defense against losses. It helps you identify entry and exit points, set stop-loss and take-profit levels, and gauge the overall market direction. In short, good analysis can help you make informed decisions, reducing the likelihood of costly mistakes.

Failure to Implement Proper Risk Management Strategies

The Importance of Stop-Loss and Take-Profit Orders

One of the most critical aspects of Forex trading is risk management, and at the heart of risk management are stop-loss and take-profit orders. A stop-loss order helps you limit your losses by automatically closing a trade when it reaches a certain loss level. Similarly, a take-profit order locks in your gains when a trade reaches a specified profit level.

Risk to Reward Ratio

Understanding the risk-to-reward ratio is crucial for successful trading. This ratio helps you quantify the potential reward for every unit of risk you take. A favorable risk-to-reward ratio (e.g., 1:3) means that the potential profit is three times the potential loss, making the trade worth the risk.

The Impact of Risk On Trading Outcomes

How Risk Levels Affect Potential Profits and Losses

The level of risk you’re willing to take directly impacts your potential profits and losses. Higher risk can lead to higher rewards, but it also increases the likelihood of significant losses. Balancing risk and reward is a delicate act that requires experience and sound judgment.

The Concept of Risk Return Ratio

The Risk Return Ratio is a measure that helps traders understand the relationship between the risk taken and the return achieved on an investment. A higher ratio indicates a better risk-adjusted return, making it an essential metric for evaluating the effectiveness of your trading strategy.

The Role of Emotion in Trading Decisions

Emotional Pitfalls Like Fear and Greed

Emotions can be a trader’s worst enemy. Fear can make you exit a profitable trade too early, while greed can make you hold on to a losing trade for too long. Both can be detrimental to your trading success.

Strategies for Emotional Discipline

Mastering emotional discipline involves developing strategies to manage your emotional responses. This can include setting predefined rules for trading, practicing mindfulness, and even taking breaks when emotions run high. The goal is to make decisions based on logic and analysis, not emotional impulses.

Top Reasons Why Forex Traders Fail and Lose Money

In our journey through the complexities of Forex trading, we’ve touched on several factors that contribute to the high failure rate among traders. Let’s summarize these key reasons:

- Poor Risk Management: Failure to implement stop-loss and take-profit orders, as well as an unfavorable risk-to-reward ratio, can lead to significant losses.

- Lack of Information: Trading without up-to-date market information is like sailing without a compass—you’re bound to get lost.

- Emotional Trading: Letting emotions like fear and greed dictate your trading decisions can derail even the most promising trading strategy.

How to Improve Your Forex Trading

Improvement in Forex trading doesn’t happen overnight. It’s a continuous process that requires dedication, hard work, and a willingness to learn. Here are some actionable tips and strategies to help you improve:

Actionable Tips and Strategies for Improvement

- Educate Yourself: The first step in becoming a successful trader is education. Make use of online courses, books, and seminars to enhance your trading knowledge.

- Practice with a Demo Account: Before diving into live trading, practice with a demo account to get a feel for the market and to test your strategies.

- Develop a Trading Plan: A well-thought-out trading plan serves as your roadmap, helping you make informed decisions.

- Keep Emotions in Check: Develop emotional discipline by setting trading rules and sticking to them.

- Regularly Review and Adjust: Periodically review your trading performance and make necessary adjustments to your strategies.

The Importance of Hard Work and Effort in Achieving Success

There’s no shortcut to success in Forex trading. It requires a significant investment of time and effort. The traders who succeed are the ones who put in the hard work to understand the market, develop sound strategies, and continually refine their approach.