Table of Contents

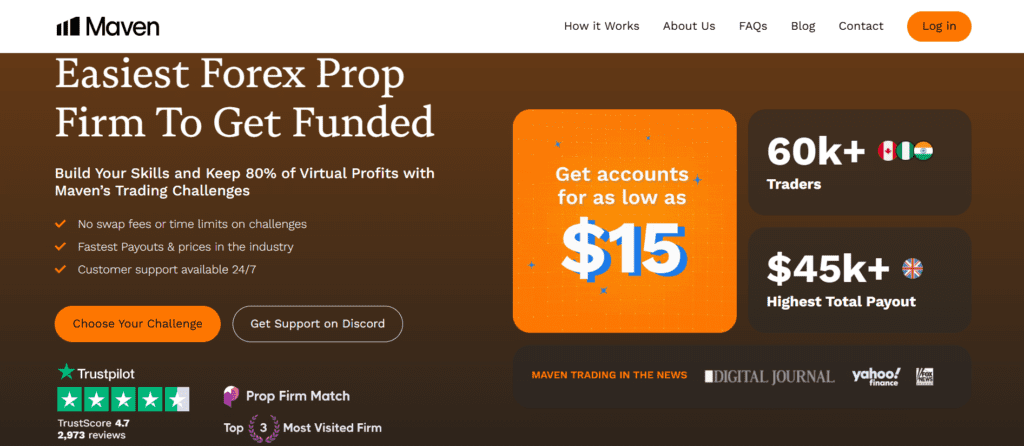

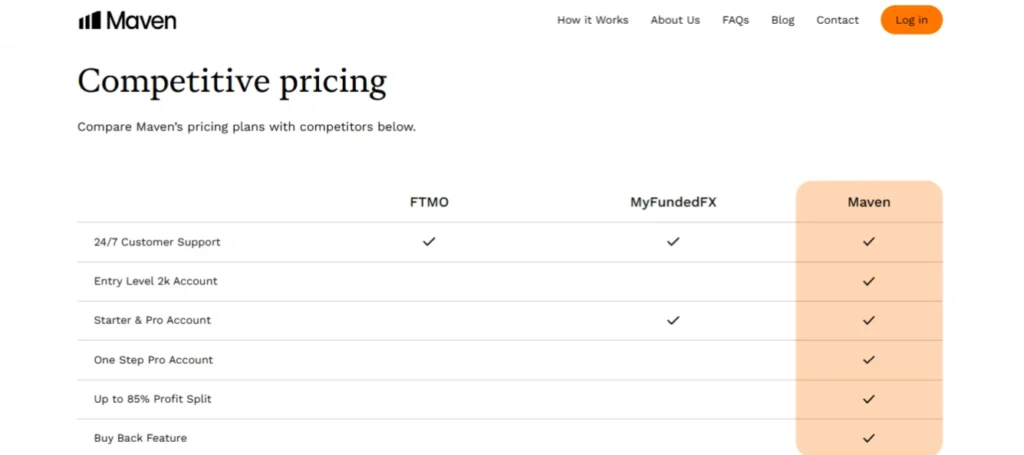

Maven Trading is a proprietary trading firm that gives you a funded account for the price of a decent sandwich. We waded through the murky swamp of budget prop firms, where “support team” means one guy named Rico on Discord. Then came Maven: shockingly normal. A website that loads, pricing that makes sense, and zero influencers screaming into ring lights.

Oh, and they’re Canadian, so if things go sideways, they might even say sorry.

Maven is probably one of the best cheapest prop firms out there, with little negative feedback. But is it genuinely a bargain, or just another suit in disguise shouting “Trust me, bro”? Let’s go into detail in this Maven prop firm review.

Maven’s features? Surprisingly useful. Like finding WiFi in a forest.

Key Features of Maven Trading

- Entry Costs That Scream “Impulse Buy” – $15.

- Multiple Account Types – Choose from 1-Step, 2-Step, or 3-Step challenges.

- No Swap Fees – Hold positions overnight without incurring extra charges.

- Unlimited Time for Challenges – No time restrictions on completing evaluation phases.

- Fast Payouts – Withdraw profits every 10 business days.

- Buyback Feature – Regain access to a funded account after a drawdown breach without retaking a challenge.

- Scaling Program – Scale up to $1,000,000 in funding.

Challenge Account Options

Maven Trading provides three challenge models: 1-Step, 2-Step, and 3-Step. The fewer the steps, the faster the funding (and the higher the blood pressure). Each has different rules, pricing, and risk management requirements.

1-Step Challenge: For Traders Who Want It Fast and Furious

Just one phase, one target, and a trailing drawdown that follows you.

- Refundable Fee: Starts at $15 (varies based on account size)

- Account Size: $2,000 – $100,000

- Profit Target: 8%

- Drawdown Structure:

- Overall Drawdown: 5% (Trailing)

- Daily Drawdown: 3%

- Profit Split: 80% minimum

- Special Features: Weekend holding, swap-free trading, buyback option.

The trailing drawdown means that as your account grows, the drawdown limit moves with your highest achieved equity, making risk management more challenging.

2-Step Challenge: For Traders Who Like Foreplay

The 2-Step is the classic. Like blue jeans or revenge trading, it never goes out of style.

- Refundable Fee: $19+

- Account Size: $2,000 – $100,000

- Profit Target:

- Phase 1: 8%

- Phase 2: 5%

- Drawdown Structure:

- Overall Drawdown: 8% (Static)

- Daily Drawdown: 4%

- Profit Split: 80% minimum

- Special Features: Weekend holding, swap-free trading, buyback option.

Unlike the 1-Step Challenge, the 2-Step and 3-Step Challenge has a static 8% drawdown.

3-Step Challenge: The Calmest Way to Get Funded

The newest challenge model with the lowest entry cost. This one’s basically the yoga class of trading.

- Refundable Fee: $15+

- Account Size: $2,000+

- Profit Target: 3% / 3% / 3%

- Drawdown Structure:

- Overall Drawdown: 3% (Static)

- Daily Drawdown: 2%

- Profit Split: 80% minimum

- Special Features: Weekend holding, swap-free trading, buyback option.

Comparison of Challenge Accounts

| Feature | 1-Step | 2-Step | 3-Step |

|---|---|---|---|

| Fee Range | $15 – $379 | $15 – $379 | $15 – $379 |

| Profit Target | 8% | 8% / 5% | 3% / 3% / 3% |

| Overall Drawdown | 5% (Trailing) | 8% (Static) | 3% (Static) |

| Daily Drawdown | 3% | 4% | 2% |

| Profit Split | 80% | 80% | 80% |

| Special Feature | Trailing Drawdown | Static Drawdown | Static Drawdown |

Differences Between the 2-Step and 1-Step Accounts

Differences Between the 1-Step, 2-Step, and 3-Step Challenges

They all test your skills, but in slightly different flavors of pain: profit targets, drawdowns, and how many phases you survive

1-Step vs. 2-Step

- 1-Step has a trailing drawdown (5%), which moves with your highest equity, while 2-Step has a static drawdown (8%) that stays fixed.

- 2-Step has two evaluation phases (8% → 5%), while 1-Step only requires one phase (8%).

- Daily drawdown is more lenient in 2-Step (4%) compared to 1-Step (3%), giving traders more breathing room.

2-Step vs. 3-Step

- 3-Step is the easiest to pass, with a lower profit target (3% per phase) compared to 2-Step (8% → 5%).

- 3-Step has a stricter overall drawdown (3%), while 2-Step allows up to 8%.

- Daily drawdown is tighter in 3-Step (2%), making risk management more restrictive.

1-Step vs. 3-Step

- 1-Step is faster but riskier, with a higher profit target (8% in one phase) and a trailing drawdown (5%).

- 3-Step has the lowest profit targets (3% per phase) but a stricter drawdown policy (3% overall, 2% daily).

- 1-Step rewards aggressive trading, while 3-Step favors a slow, low-risk approach.

Quick recap: 1-Step is for speed demons, 2-Step is the middle path, and 3-Step is for people who bubble-wrap their trades.

Scaling, Commissions, Instruments, and Leverage

Scaling

Maven lets you scale all the way up to a cool $1 million in funding, if you can hit targets like a robot with no emotions.

- Profit Requirement: Achieve a 10% profit over 4 months (2.5% per month).

- Payout Requirement: Process at least 1 payout per month.

- Account Increase: Accounts are rewarded with a 25% increase upon meeting these criteria.

Spreads & Commissions

While other prop firms keep spreads slim, Maven’s are… let’s say, generously padded.

Expect numbers like:

| Currency Pair | Spread |

|---|---|

| AUDCAD | 14 pips |

| AUDJPY | 9 pips |

| CHFJPY | 15 pips |

| EURAUD | 15 pips |

| EURGBP | 7 pips |

- Commission Fee: $2 per side ($4 round trip).

- No Commissions on Crypto, Indices, and Commodities.

- No Swap Fees.

It’s less “tight execution” and more “did I just trade during a solar flare?”

Available Instruments

Maven lets you trade the usual suspects. FX, indices, commodities, crypto. But the spreads? Let’s just say they’re not shy.

Markets & Leverage

| Asset Class | Leverage |

|---|---|

| Forex | 75:1 |

| Commodities | 20:1 |

| Indices | 20:1 |

| Digital ETFs | 2:1 |

Payout Structure

Maven Trading has a 10-business-day payout cycle, but there are some limitations:

- Minimum Profit Split: 80%

- Withdrawal Frequency: Every 10 business days.

- Full Refund: Issued on the third withdrawal.

- Withdrawal Cap: Maximum $10,000 per two payout cycles.

- Single Trade/Trading Day Rule: If a trade or trading day exceeds 50% of the total profit, the profit may be reduced. In other words, no jackpot trades.

Buyback Feature

Breached your drawdown? No problem. With Maven’s buyback option, you can re-enter without starting over, just pay a fee based on the damage:

- $2,000 Account = $200

- $5,000 Account = $400

- $10,000 Account = $750

- $20,000 Account = $1,400

- $50,000 Account = $3,500

- $100,000 Account = $6,000

Think of it as hitting the “continue” button in an arcade game. Costly, but at least you don’t have to start from Level 1 again.

Enter MVN8 to get 8% Off on every account size except 100k accounts

Rules and Restrictions

Maven Trading has specific rules and restrictions to ensure fair and ethical trading practices. Here are some key policies:

IP Address Policy

Stick to your region. Log in from a different timezone, and you’ll need to show receipts—literally. Your IP needs to stay put. Change locations, and Maven wants evidence. Tickets, GPS, or maybe a tearful vlog from the airport or, a handwritten letter from your Airbnb host.

Cheating and Prohibited Practices

- Cheating: No HFT, no tick scalping, no shady arbitrage tricks, and definitely no copying your smarter friend’s trades.

- Reverse/Group Hedging: Betting both sides with different accounts? That’s not a hedge, that’s a hustle.

- Hedging: Exclusive hedging is prohibited. If caught, they’ll want to see your EA, and maybe your browser history.

EAs (Expert Advisors)

EAs are permitted if they don’t break the above rules. If yours trades like it’s laundering crypto, be ready to show the code.

Trading Style Rules

- Excessive Scalping: Holding 50% or more of trades for less than a minute, that’s gambling.

- Martingale: Having five positions opened simultaneously in drawdown on the same pair, not allowed.

- All in: Betting one direction without risk management (no stop-loss), not allowed.

News Trading

Traders aren’t allowed to open or close trades within 2 minutes before or after a red-folder news event. You can hold positions during the release, but any profit made during that window won’t count toward your challenge or live account. So yeah, even if you accidentally nail it, you’re not getting credit.

Consequences

Break the rules, and it’s game over. Account terminated, challenge disqualified, no do-overs. They enforce this stuff hard, so don’t test it unless you like starting from scratch.

Steps to Get Funded

- Complete a Trading Challenge: Pick the 1-Step, 2-Step, or 3-Step and prove you know what you’re doing.

- Verification: For the 2-Step or 3-Step challenge, you pass phase 1 and move to the next one under easier rules, just to show it wasn’t beginner’s luck.

- Become a Funded Trader: You’re funded. Sort of. It’s simulated capital, but real profits.

- Withdraw Profits: Pick your payout settings and start collecting, assuming you didn’t blow it.

Customer Support & Education

- 24/7 Live Chat Support, but responses are often generic.

- Discord Community: 60,000+ members.

- No Phone Support.

- Limited Educational Content (Basic FAQs and Blog).

Maven Trading Trustpilot Reviews

Maven’s got a Trustpilot score of 4.6 out of 5 from over 1,200 reviews. That’s not just good. It’s “people actually bothered to leave a nice review” good. Here’s what traders are raving about:

Key Themes in Reviews

- Customer Support:

- Maven gets regular props for its support team—fast replies, respectful tone, and real problem-solving.

Bob V. from Alabama shouted out staffer Tuvi for smooth payouts and fair treatment.

- Maven gets regular props for its support team—fast replies, respectful tone, and real problem-solving.

- Payout and Verification Speed:

- Speed matters, and traders are loving the fast withdrawals and quick KYC checks.

Usama Akbar from Pakistan said his first payout hit in just 15 minutes.

- Speed matters, and traders are loving the fast withdrawals and quick KYC checks.

- Fair and Transparent Rules:

- Straightforward rules, no sneaky clauses. Compared to most firms, that’s a win.

Alastair from Great Britain liked the swap-free accounts and the clarity in rules.

- Straightforward rules, no sneaky clauses. Compared to most firms, that’s a win.

- Platform and Pricing:

- Many call Maven a solid value—good pricing, decent platform, no fuss.

Swapnil Nikade from India praised the support team and pricing as a major plus.

- Many call Maven a solid value—good pricing, decent platform, no fuss.

- Community and Trust:

- A strong Discord and overall trust in the system come up again and again.

Ketchy from Nigeria called it the best prop firm they’ve used, thanks to quick payouts and solid support.

- A strong Discord and overall trust in the system come up again and again.

Areas for Improvement

Overall, the reviews are strong. Some traders did flag timezone quirks and inconsistent support, but those gripes seem to be the exception, not the rule.

Final Verdict: Is Maven Trading Worth It?

If you’re looking to get funded without selling a kidney, Maven’s a strong contender. Challenge fees start at just $15, there’s no ticking clock breathing down your neck, and you’ve got options: 1-Step, 2-Step, 3-Step. There’s even a scaling plan that goes all the way to $1 million. Blow your account? You can buy it back. It’s prop firm reincarnation.

The payout system is reliable, running every 10 business days like a well-behaved metronome. Most traders report smooth withdrawals, and there’s 24/7 live chat support if things go sideways. Plus, with over 60,000 members in their Discord, it’s one of the livelier corners of prop firm internet.

Now, let’s not gloss over the fine print. Spreads are chunky. If you’re scalping, you’ll feel it. And there’s no MT4/MT5. If you’re married to MetaTrader, you’ll need to get cozy with cTrader or Match-Trader instead. On the plus side, both come with TradingView integration.

Bottom line? Maven’s not perfect. But it’s cheap, flexible, and pays out on time. If you can stomach the spreads and don’t mind switching platforms, it’s absolutely worth a shot.

![Funded Picker Review (2025) + 15% Discount Code [PFR15] 9 funded picker](https://propfirmreviews.net/wp-content/uploads/2025/08/funded-picker-1024x576.jpg)