Table of Contents

Stocknet Institute, a UK-based fintech company, is recognized as the premier virtual trading platform, offering instant funding for traders under a variety of plans. This initiative allows traders to start earning from day one with a potential virtual trading capital of up to $7.68 million.

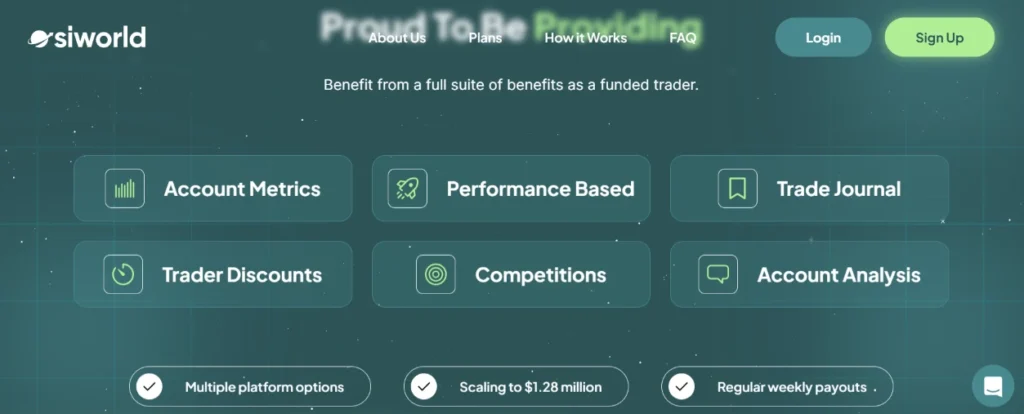

Key Features of Stocknet Institute:

- Instant Funding: Traders can begin trading with funds provided by Stocknet Institute almost immediately.

- Diverse Trading Instruments: The platform supports trading across more than 2000 instruments including FX pairs, indices, commodities, cryptos, stocks, and futures.

- Variety of Plans: There are multiple trading plans available, each offering unique benefits and tailored to different trading strategies and goals.

- Global Reach: Serving over 40,000 users from 180 countries, the firm has established a strong global presence.

- Customer Praise: Users have consistently praised the platform for its reliability in payouts, customer service, and overall trading experience.

Special Plans:

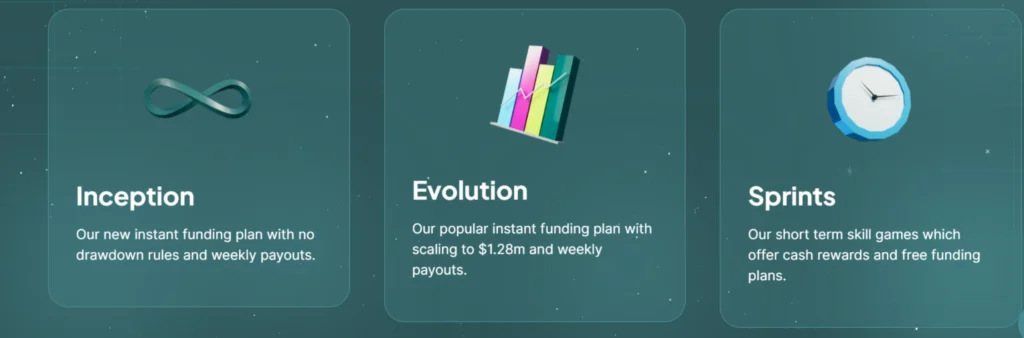

Inception

The Inception plan from Stocknet Institute is designed as an innovative funding solution for traders, emphasizing flexibility and opportunity. Here’s an overview of its key features:

Plan Description

- No Drawdown or Loss Limits: The Inception plan is unique because it eliminates the common restrictions like drawdown rules or loss limits. This allows traders to operate without the typical boundaries that might hinder their trading strategies.

- Weekly Rewards: Traders can earn weekly rewards based on their performance, encouraging consistent activity and profitability.

- Risk Management Rules: To promote good trading habits and effective risk management, the plan includes a maximum lot per day and a maximum number of trades per day.

Account Information

- Account Type: Standard

- Max Drawdown: None

- Profit Target: None

- Time Limit: Unlimited

- Minimum Trading Days: None

- Max Trades Per Day: 10

- Profit Split: 15%

- Payout Schedule: Weekly payouts every Friday

- Inactivity Rule: There are no penalties or rules regarding account inactivity.

This plan is particularly suitable for traders who prefer a more unrestricted trading environment, offering them the freedom to experiment and trade without the fear of hitting stringent loss limits.

Evolution

The Evolution plan is a core offering from Stocknet Institute, aimed at rapidly escalating the scale of trading accounts through performance-based incentives.

Plan Description

- Account Doubling: The plan allows for the doubling of the account size each time a trader achieves a 10% growth, with the potential to scale up to $1.28 million.

- Instant Funding: Traders can start immediately without any evaluations or challenges. They can choose from six different starting sizes, allowing flexibility in how they enter the trading environment.

- Drawdown Limits and Scaling Targets:

- Standard Mode: Features a fixed 8% max drawdown and a 10% scaling target.

- Dynamic Mode: Offers a more lenient 12% max drawdown and a 15% scaling target, providing more flexibility in trading strategies.

Account Information for Both Modes

- Starting Account Sizes: Ranges from $1,250 to $640,000.

- Max Drawdown: 8% for Standard; 12% for Dynamic.

- Scaling Target: 10% for Standard; 15% for Dynamic.

- Scale To: Potential to scale up to $1.28 million.

- Time Limit: Unlimited.

- Minimum Trading Days: None.

- Profit Split: Varies between 60% to 80%, depending on the plan and performance.

- Payout Schedule: Weekly payouts every Friday.

- Inactivity Rule: None.

- Drawdown Type: Static for Standard; presumably flexible for Dynamic based on the mode.

Key Differences Between Standard and Dynamic Modes

- Drawdown Allowance: Dynamic mode offers a higher drawdown limit.

- Scaling Target: Dynamic mode requires a higher performance target to double the account size, suitable for traders who prefer more leeway in their trading approach.

The Evolution plan is tailored for traders who aim for rapid growth in their trading capital and are capable of consistently hitting growth targets. The choice between Standard and Dynamic modes allows traders to select a plan that best matches their trading style and risk tolerance.

Sprints

The Sprints plan at Stocknet Institute is designed as a series of trading challenges that not only enhance traders’ skills but also offer significant rewards for successful completion.

Plan Description

- Purpose: Sprints are targeted challenges that focus on different trading competencies, such as scalping, swing trading, or other specific strategies. They are intended to test and improve traders’ skills in various aspects of trading.

- Difficulty Levels: Each Sprint has a designated difficulty level, with harder challenges offering greater rewards.

Sprint Structure

- Number of Active Sprints: Traders can have up to three active Sprints of each type at any time, allowing for a maximum of 18 active Sprints concurrently.

- Completion and Availability: New Sprints become available as current ones are completed or failed, ensuring ongoing opportunities for engagement and reward.

Starting a Sprint

- Flexibility: Traders are free to choose any Sprint they wish to participate in, depending on their confidence and skill in particular trading strategies.

- Rewards: Some Sprints offer larger monetary rewards and free funding plans, making them particularly attractive.

Claiming Rewards

- Notification: Upon successful completion of a Sprint, traders receive a notification within their SI World account.

- Claim Process: Traders can claim their rewards through the account dashboard by clicking the “Claim Reward” button. Monetary rewards are added directly to the trader’s Wallet, and any free funding plans won can be activated at no cost.

The Sprints plan is ideal for traders looking to challenge themselves and sharpen specific trading skills while having the opportunity to earn monetary rewards and free funding plans, providing both educational and financial incentives.

Customer Support and Feedback:

The platform is well-regarded for its supportive customer service team, available via live chat and email. Feedback from users highlights the efficient service and the excellent trading environment provided by Stocknet Institute.

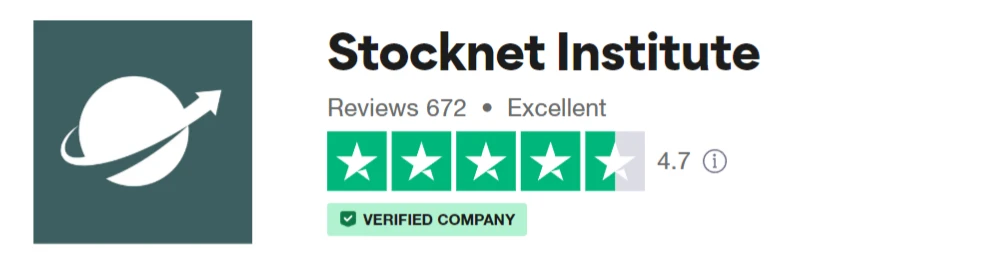

Trustpilot Reviews for Stocknet Institute

Stocknet Institute has garnered an impressive rating of 4.7 out of 5 stars on Trustpilot, based on feedback from 672 customers, classifying it as “Excellent” in the software company category. This high score indicates a strong level of customer satisfaction and positions Stocknet Institute positively in the market. Here’s a more detailed look at the feedback trends:

Positive Highlights:

- Customer Support: Many reviewers highlighted exceptional customer service, particularly praising staff members like Henry for their responsiveness and effective resolution of issues.

- Efficient Payouts: Customers have reported fast and reliable payout processes, which is a crucial aspect for traders using proprietary trading platforms.

- User Experience: The platform’s user interface and trading conditions have been well-received, with traders appreciating the transparency and simplicity of the system.

Addressing Negative Feedback:

- Resolution of Issues: While the majority of reviews are positive, Stocknet Institute has actively responded to negative feedback. They have engaged with dissatisfied customers to address their concerns, often within 24 hours of a review being posted.

- Consistency in Quality: Despite a few negative comments, the general consensus among users is that the benefits and overall performance of Stocknet Institute outweigh the occasional hiccup.

Cautionary Note:

Despite the high rating, potential clients should consider all aspects of the service, including any negative reviews and the company’s responses to them. It’s important to evaluate whether the platform suits your specific trading needs and risk tolerance. Engaging with any financial service platform should always be done with careful consideration of both the positive and negative feedback to ensure a well-informed decision.

![Funded Picker Review (2025) + 15% Discount Code [PFR15] 5 funded picker](https://propfirmreviews.net/wp-content/uploads/2025/08/funded-picker-1024x576.jpg)