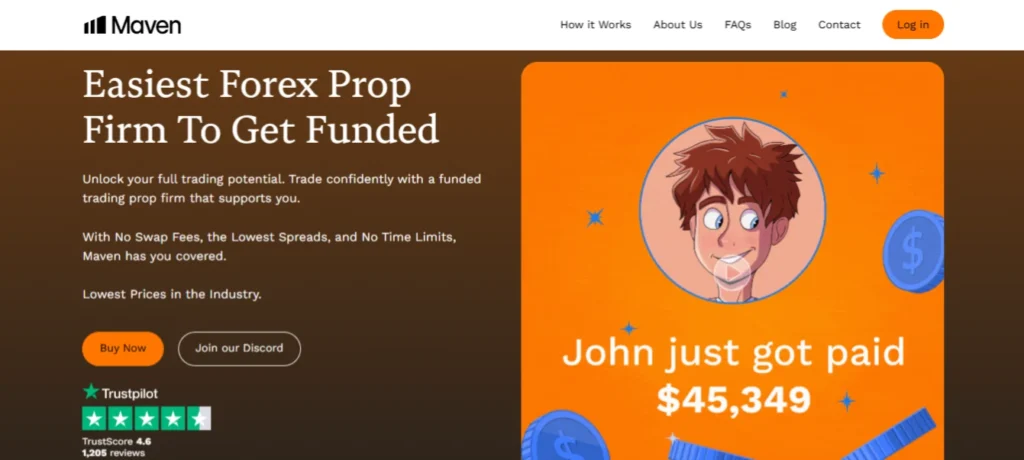

Maven Trading is a proprietary trading firm that lets traders use funded accounts. We looked at a bunch of cheap prop firms, and honestly, a lot of them are pretty sketchy. But Maven Trading is different. They stand out as a reliable and cost-effective option. We even found a prop firm that lets you name your price! Yes, feels like clicking on a pop-up ad that promises a free vacation and thinking, ‘This is definitely legit.’

Maven is probably one of the best cheapest prop firms out there, with little negative feedback. They focus on keeping costs low and being dependable, which makes them a great choice for traders at all levels.

Let’s start with an overview of Maven Trading and what makes them stand out.

Key Features of Maven

- Buyback Feature: Quickly regain access to funded accounts by paying 60% of the drawdown limit.

- Funded Accounts: Trade with accounts ranging from $2,000 to $100,000.

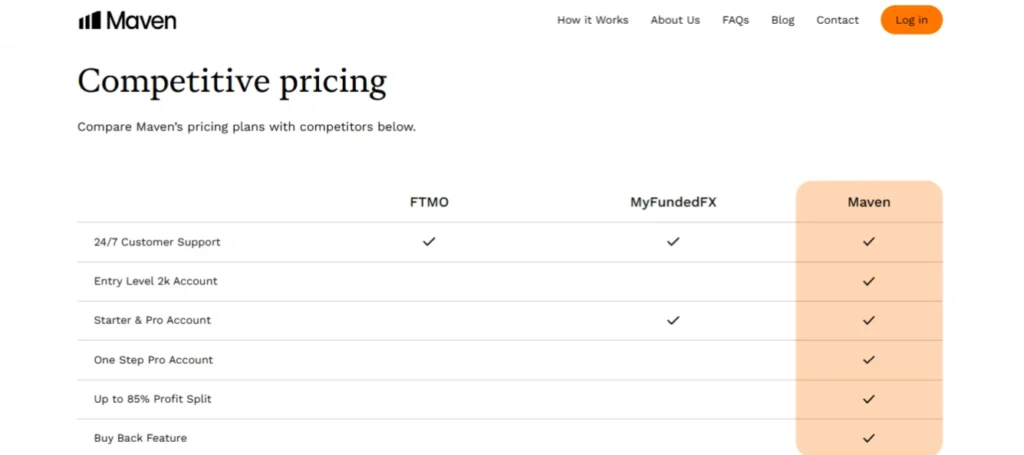

- Competitive Pricing: Affordable entry costs, e.g., $299 for a $100K account.

- Zero Swap Fees: No fees for holding positions overnight.

- Close to Raw Spreads: Low spreads on all pairs.

- No Time Limits: Unlimited trading days to meet profit targets.

- Scaling Program: Scale accounts up to $1,000,000.

- Platform and Asset Flexibility: Maven supports trading across a wide range of assets, including 400+ virtual pairs, FX majors & minors, and equities on simulated accounts.

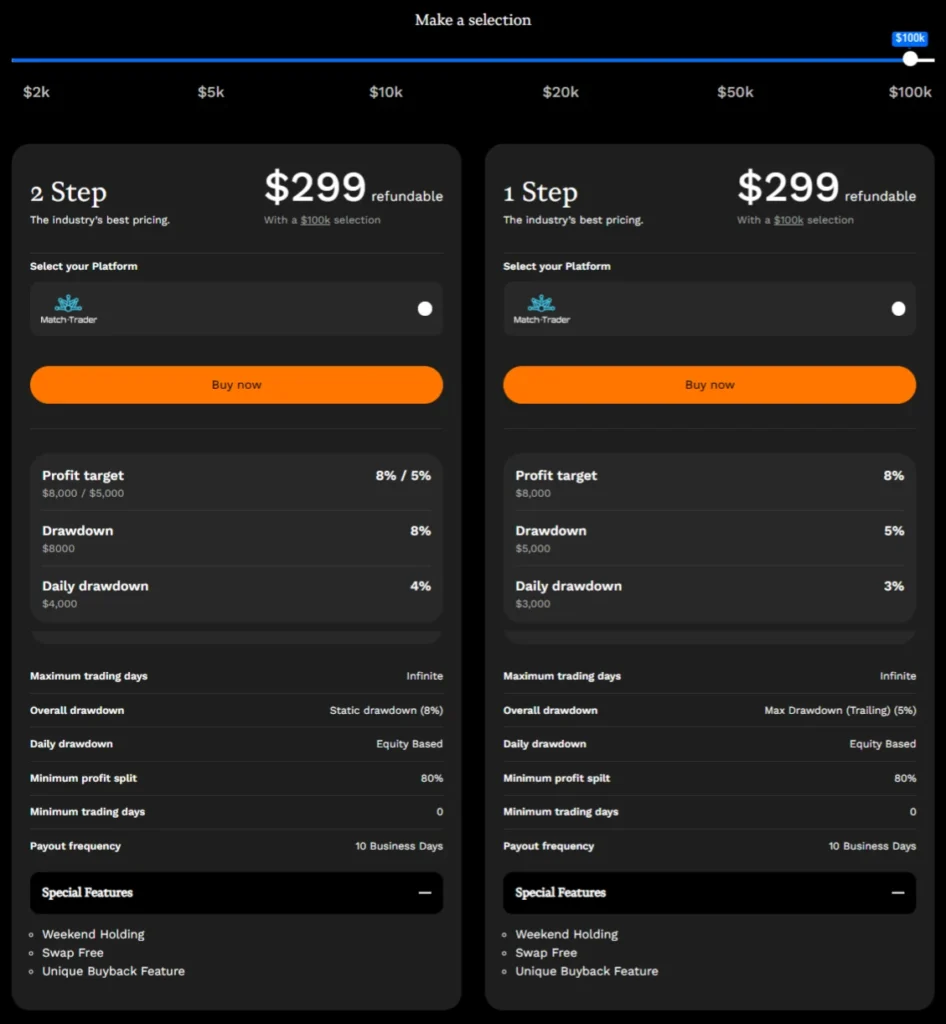

2-Step Account Overview

Maven Trading offers a highly competitive 2-step account, especially their $100K account priced at just $299, making it a very affordable option compared to competitors. Here’s a detailed look at the $100K 2-step account:

Account Features:

- Price: $299 (refundable)

- Profit Target:

- Step 1: 8% ($8,000)

- Step 2: 5% ($5,000)

- Drawdown Limits:

- Overall: 8% ($8,000)

- Daily: 4% ($4,000)

- Trading Days: Unlimited

- Profit Split: Minimum 80%

- Payout Frequency: Every 10 business days

1-Step Account Overview

Now, let’s examine the 1-step account. We’ll use the $100K account as an example, which is also priced at $299, offering excellent value. We’ll also compare the differences between the 1-step and 2-step accounts.

Account Features:

- Price: $299 (refundable)

- Profit Target: 8% ($8,000)

- Drawdown Limits:

- Trailing Drawdown: 5% from your highest equity

- Daily Drawdown: 3% ($3,000)

- Trading Days: Unlimited

- Profit Split: Minimum 80%

- Payout Frequency: Every 10 business days

Special Features of 1-Step & 2-Step Account:

- Weekend Holding: Allows holding positions over the weekend.

- Swap-Free: No swap fees for holding positions overnight.

- Unique Buyback Feature: It allows traders to quickly regain access to a funded account without needing to take additional challenges. If you breach the daily maximum or drawdown limit, you can open a support request and pay 60% of the drawdown amount your account has experienced.

Differences Between the 2-Step and 1-Step Accounts

While both the 2-step and 1-step accounts from Maven Trading are priced at $299 and offer a $100K funding option, there are key differences:

Drawdown Limits:

The drawdown limits for the 2-Step and 1-Step accounts at Maven Trading are structured to manage risk differently:

- 2-Step Account: Features a static overall drawdown of 8% ($8,000) and a daily equity-based drawdown of 4% ($4,000). The equity-based drawdown resets based on the highest equity or balance at 00:00 UTC.

- 1-Step Account: Implements a trailing drawdown of 5% from the highest equity and a daily balance-based drawdown of 3% ($3,000). The trailing drawdown adjusts with the highest equity point in your account.

This distinction offers flexibility in managing risk: the 2-Step account has fixed limits, while the 1-Step account adjusts dynamically to equity changes.

Simplicity and Flexibility:

- 2-Step: Involves passing two stages with higher overall drawdown tolerance.

- 1-Step: Involves a single stage with a trailing drawdown, making it simpler but with stricter drawdown conditions.

Both accounts share features like no time limits, weekend holding, swap-free trading, and a unique buyback option, ensuring flexibility and trader-friendly conditions. It’s up to you whether you feel the drawdown is worth it, considering the 2-Step account requires passing an extra step but offers a fixed drawdown, while the 1-Step account adapts to equity changes dynamically.

Scaling, Commissions, Instruments, and Leverage

Scaling

Maven Trading offers the ability to scale your account up to $1,000,000 in capital. To qualify for scaling:

- Profit Requirement: Achieve a 10% profit over 4 months (2.5% per month).

- Payout Requirement: Process at least 1 payout per month.

- Account Increase: Accounts are rewarded with a 25% increase upon meeting these criteria.

Commissions and Spreads

- Forex Commission: $2 USD per way ($4 USD round trip). For non-USD pairs, commission auto-converts to USD.

- Crypto, Indices, and Commodities: $0 commissions.

- Spreads: Close to raw spreads.

- Swap Fees: Zero swap fees across all accounts.

Instruments

Maven Trading provides various instruments, including all major FX pairs, commodities, indices, and digital ETFs.

Leverage

- Forex: Up to 75:1

- Commodities and Indices: Up to 20:1

- Digital ETFs: Up to 2:1

These features give traders flexible and budget-friendly ways to trade a wide range of instruments, helping them take advantage of market movements more effectively.

Payouts

Let’s talk about the most important part for a trader: payouts. It’s crucial to be cautious with cheap prop firms, as they often complicate the payout process. However, Maven Trading is an exception. They are reliable in terms of payouts and offer competitively priced accounts. They are attractively low for the quality and reliability offered. Now, they do have a withdrawal/payout cap though. It’s not new, since more and more prop firms are starting to implement withdrawal caps.

Payout Details:

- Payout Frequency: Every 10 business days

- Profit Split: start at 80% 85%

- Withdrawal Methods: Digital currencies and direct bank transfers (country-dependent)

- Withdrawal Cap: Maximum withdrawal of $10,000 per two withdrawal cycles. As your account scales, the cap scales proportionally. Multiple accounts are treated as one for withdrawal purposes.

- Example: For a $100,000 account, if you profit $8,000 in the first cycle and $6,000 in the second, you can withdraw a total of $10,000.

- Profit Exceeding $5,000: If total profit exceeds $5,000, the best trading day or singular trade may not exceed 50% of the profit in the funded stage payout cycle. Exceeding this will contract profits to the 50% mark.

- Example: If you make $5,000 on day 1 and $3,000 on day 2, you can withdraw a total of $6,000 before the split.

- Withdrawal Frequency: Standard accounts withdrawals can be requested every 10 business days. A full refund is issued on the third withdrawal.

- Max Lifetime Withdrawals: After profits of $100,000, you graduate from the Maven program. Each account scale increases the maximum withdrawal proportionally.

These conditions ensure that traders have consistent and reliable access to their earnings while maintaining an affordable entry cost.

Rules and Restrictions

Maven Trading has specific rules and restrictions to ensure fair and ethical trading practices. Here are some key policies:

IP Address Policy

Your IP address for Phase 1, Phase 2, and live accounts must match the same geographical region to verify you didn’t receive outside assistance. If your IP address changes, you will need to provide proof and an explanation, such as plane tickets or live location checking.

Cheating and Prohibited Practices

- Cheating: Prohibited activities include high-frequency trading, toxic trading order flow, long/short arbitrage, reverse arbitrage, tick scalping, and server execution. Copy trading from another individual is also forbidden.

- Reverse/Group Hedging: Using one account to bet against another is not allowed.

- Hedging: Exclusive hedging is prohibited. If found, you may need to provide the EA (Expert Advisor) used.

EAs (Expert Advisors)

EAs are permitted if they do not break the above rules. Proof of the EA may be required to ensure it is not malicious.

Trading Style Rules

- Excessive Scalping: Holding 50% or more of trades for less than a minute is considered gambling.

- Martingale: Having five positions opened simultaneously in drawdown on the same pair is not allowed.

- All in: Betting one direction without risk management (no stop-loss) is prohibited.

News Trading

Traders can’t open or close trades 2 minutes before or after a red folder news event release. You’re allowed to hold trades during the news event, but any profits made during this time won’t be credited during the challenge or live phase.

Consequences

If you break these rules, it could result in your account being terminated or you getting disqualified from the challenge. They enforce these restrictions strictly to keep things fair and transparent for everyone.

Steps to Get Funded

- Complete a Trading Challenge: Traders prove their trading skills by completing either the 1-Step or 2-Step challenge.

- Verification: For the 2-Step challenge, traders must redo the challenge under easier rules to ensure consistent performance.

- Become a Funded Trader: Successful traders receive a simulated funded account and can start trading.

- Withdraw Profits: Traders can set their payout preferences and withdraw profits at any time.

Community and Support

- Discord Community: With over 40,000 members, Maven Trading fosters a strong community of traders.

- Customer Support: Highly rated support with quick responses and effective resolution of issues.

- Educational Resources: Maven Trading offers various articles and educational content on topics such as trading psychology, setting trading goals, and understanding funded trading accounts.

Maven Trading Trustpilot Reviews

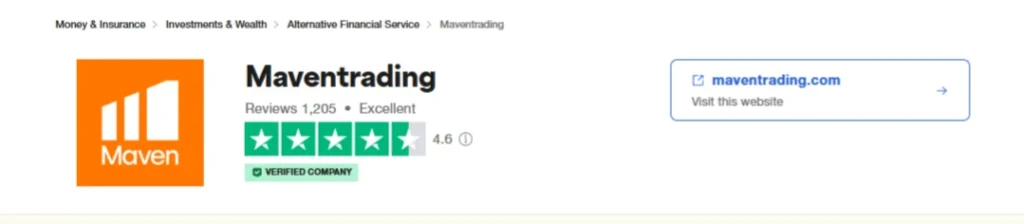

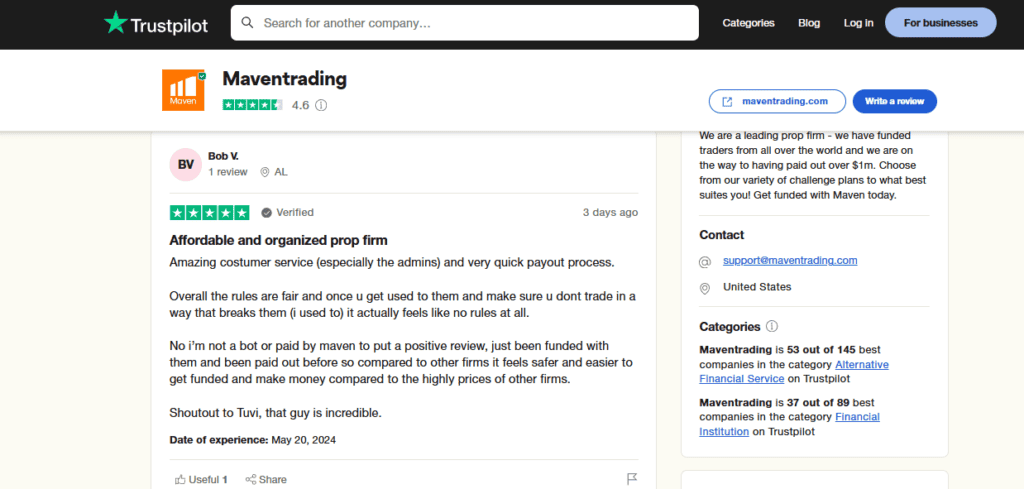

Maven Trading has built a solid reputation among traders, which is clear from its impressive Trustpilot score of 4.6 out of 5, based on 1,205 reviews. Here are some insights into what traders love about Maven Trading:

Key Themes in Reviews

- Customer Support:

- Many reviewers highlight the exceptional customer service provided by Maven Trading. Quick response times, polite interactions, and effective issue resolution are common praises.

- Example: Bob V. from Alabama appreciates the quick payout process and fair rules, mentioning a specific staff member, Tuvi, for outstanding service.

- Payout and Verification Speed:

- Traders often commend Maven Trading for its fast payout system and quick KYC approval.

- Example: Usama Akbar from Pakistan was impressed by receiving his first payout within 15 minutes of the request.

- Fair and Transparent Rules:

- Reviewers note that Maven Trading has straightforward and transparent rules without hidden clauses, which is a significant advantage over many other firms.

- Example: Alastair from Great Britain finds Maven’s rules simple and the swap-free accounts beneficial.

- Platform and Pricing:

- The competitive pricing and platform features are frequently praised, with users finding Maven’s offerings cost-effective compared to other prop firms.

- Example: Swapnil Nikade from India commends the swift and friendly assistance received from the support team.

- Community and Trust:

- Maven Trading’s supportive community and trustworthiness are recurrent themes in positive reviews.

- Example: Ketchy from Nigeria appreciates the quick payout process and responsive customer service, making it the best prop firm they’ve encountered.

Areas for Improvement

Most of the reviews for Maven Trading are positive, but some users have mentioned issues with time zone differences for account resets and mixed experiences with customer support. However, these problems are less common and usually specific to individual situations.

Conclusion

Maven Trading offers a dependable environment for traders, with no swap fees, low spreads, and flexible challenges. Their transparent rules and quick payouts allow traders to focus on their strategies without worrying about hidden conditions.

With a solid Trustpilot score of 4.6 out of 5, it’s clear that Maven Trading has earned positive feedback for their responsive and effective customer support. Traders also appreciate the competitive pricing, making it an affordable way to access funded trading accounts.

In summary, Maven Trading provides a straightforward and efficient trading experience at a reasonable price, making it a great choice for those serious about their trading careers.