Table of Contents

Balance Drawdown vs Equity Drawdown: What Prop Firms Don’t Want You to Know

Hey there, traders! Ever heard the term “drawdown” and wondered what the fuss is all about? Well, if you’re considering joining a proprietary trading firm—or prop firm, as they’re commonly known—you’ll want to get familiar with this concept. Drawdown is a critical metric that can make or break your trading career, especially when you’re taking on challenges set by prop firms.

We’re not just here to define terms; we’re going deeper. This blog post aims to pull back the curtain on how prop firms operate, particularly when it comes to drawdown calculations. By the end, you’ll understand why they calculate it the way they do and how you can navigate their challenges more effectively.

The Business Model of Prop Firms

Before we dive into the nitty-gritty of drawdown, let’s take a quick look at how prop firms make their money. At a high level, these firms allocate capital to traders (like you) to trade in the financial markets. Sounds like a win-win, right? Well, there’s a catch.

💡 Did You Know? Prop firms often set up trading challenges that you need to pass to get access to their capital. Fail the challenge, and you’re usually out of the game. But here’s the thing, these firms often make money from the fees you pay to participate in these challenges. That’s right—your failure can actually be their gain.

So, why is understanding drawdown crucial in this context? Because it’s often the metric that determines whether you pass or fail these challenges. Intrigued? Keep reading.

What is Drawdown?

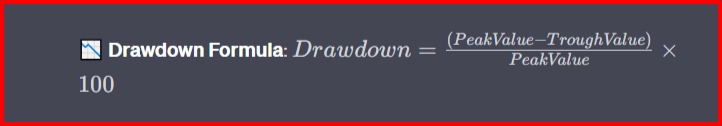

Alright, let’s get down to business. What exactly is a drawdown? In the simplest terms, drawdown is the reduction in your trading account from a peak to a trough, usually expressed as a percentage. Imagine your account hits a high of $10,000, and then it drops to $8,000. That’s a drawdown of 20%. Simple math, right?

But here’s where it gets interesting. In the context of prop firm challenges, drawdown isn’t just a measure of your trading performance; it’s often the yardstick that determines if you get to continue trading with the firm’s capital or if you’re shown the exit door.

Why is Drawdown So Crucial in Prop Firm Challenges?

- Risk Assessment: Prop firms use drawdown to gauge how much of a risk-taker you are. A higher drawdown percentage could indicate that you’re taking on too much risk, which is a red flag for the firm.

- Capital Allocation: The lower your drawdown, the more likely you are to receive a larger allocation of the firm’s capital. More capital means more trading opportunities, which is what we all want, right?

- Survival of the Fittest: In many prop firm challenges, drawdown limits are set. Exceed these limits, and you’re out. It’s as simple—and as brutal—as that.

🚨 Heads Up!: Understanding how drawdown is calculated and monitored can be the difference between sailing through a prop firm challenge and crashing out. So, it’s not just a number; it’s a make-or-break metric in this high-stakes game.

Equity vs Balance: The Basics

You’ve heard the terms Equity and Balance, especially when it comes to drawdown. But what do they really mean, and why should you care? Let’s break it down in this balance based drawdown vs equity drawdown.

What is Equity?

Think of equity as your trading account’s “live score.” It’s the real-time value of your account, factoring in your balance plus or minus the profit or loss from any open trades you have. So, if you’ve got trades that are floating in the green, your equity will be higher than your balance. On the flip side, if those trades are sinking, your equity will dip below your balance.

What is Balance?

Balance is like your account’s “static score.” It’s the money you have in your trading account, not accounting for any open trades. Your balance only changes when you close a trade, whether you’re pocketing profits or nursing losses.

🔍 Key Differences

- Real-Time vs. Static: Equity is your real-time financial snapshot, changing with the market’s ebb and flow. Balance, however, remains the same until you close a trade.

- Risk Exposure: Equity gives you an immediate sense of your risk exposure, showing you the financial impact of your open trades. Balance keeps you in the dark about this, only updating once a trade is closed.

What is Balance Based Drawdown?

Balance-based drawdown, also known as fixed drawdown, is a measure of the reduction in your trading account’s balance from its peak to its lowest point. It is calculated without taking into account the impact of any open trades in your account. In other words, balance-based drawdown focuses solely on the change in your account’s balance due to closed trades, providing a static and stable figure.

This type of drawdown is often favored by some proprietary trading firms because of its predictability and ease of monitoring. It allows firms to set fixed drawdown limits that traders should not exceed to continue trading with the firm’s capital.

What is Equity Based Drawdown?

Equity-based drawdown, also referred to as relative drawdown, considers the reduction in your trading account’s equity from its highest point to its lowest point. Equity takes into account your account balance and factors in the profit or loss from open trades. This makes equity-based drawdown a dynamic and real-time metric that reflects your account’s value as the market moves.

Proprietary trading firms that monitor drawdown against equity are interested in assessing your immediate risk exposure. They use equity-based drawdown to keep track of how open trades are impacting your account in real time.

Each approach to drawdown calculation has its advantages and disadvantages, and understanding the specific method used by your chosen prop firm is essential to effectively manage your risk and succeed in their trading challenges.

Why Do Prop Firms Care?

Now, why would a prop firm favor one over the other? Well, it often boils down to risk management. Balance offers stability—it’s a number that doesn’t dance around with market fluctuations, making it easier for the firm to set drawdown limits. Equity, with its real-time updates, can be a bit of a wild card.

Why Prop Firms Use Balance for Calculations

So, you’re getting the hang of equity and balance. But why do some prop firms lean more towards using balance when calculating drawdown? Let’s dig in.

The Benefits for Prop Firms

- Stability: Balance provides a stable, unchanging figure, making it easier for the firm to set drawdown limits and assess performance over time.

- Ease of Monitoring: With balance, there’s less noise. It’s a straightforward number that doesn’t require constant monitoring, unlike equity which can fluctuate wildly throughout the trading day.

- Simplicity: Balance is easy to understand, both for the firm and for traders. This makes communication about drawdown limits and performance evaluations more straightforward.

📊 The Prop Firm’s Perspective: Using balance for drawdown calculations offers a level of predictability that makes risk management more manageable for the firm.

The Challenge for Traders

Now, let’s flip the coin. While using balance might make life easier for the prop firm, it can pose some challenges for traders like you.

- Lack of Real-Time Risk Assessment: Since balance doesn’t account for open trades, you might not have an accurate picture of your real-time risk exposure.

- Delayed Feedback: You’ll only know the impact of your trades on your drawdown once they’re closed. This can make it tricky to manage your drawdown effectively in real-time.

- Potential for Complacency: Because balance remains static until a trade is closed, you might develop a false sense of security, thinking you’re well within drawdown limits when, in fact, your open trades could be putting you at risk.

The Real-Time Risk: Taking it from Equity

Alright, we’ve talked about why some prop firms use balance for drawdown calculations. But what about equity? Why would a prop firm decide to monitor drawdown against this ever-changing number?

Why Prop Firms Monitor Against Equity

- Real-Time Risk Assessment: Equity provides a real-time snapshot of an account’s value, which can be crucial for a prop firm that wants to assess immediate risk. If you’re in a losing trade, your equity will reflect that instantaneously.

- Dynamic Monitoring: Equity is sensitive to market conditions. For a prop firm that wants to keep its finger on the pulse of real-time market risks, equity is the go-to metric.

- Quick Decision-Making: Because equity changes in real-time, it allows prop firms to make quick decisions about capital allocation, potential intervention, or even terminating a trader’s contract.

🔥 Hot Take: Monitoring drawdown against equity allows prop firms to manage risk dynamically, adapting to market conditions as they unfold.

The Pitfall for Traders

Now, while this might sound great for the prop firm, it comes with its own set of challenges for traders.

- Vulnerability to Market Volatility: Because equity is so sensitive to market conditions, a sudden market move against your position can cause you to violate drawdown limits quickly.

- Constant Vigilance Required: With equity-based drawdown monitoring, you need to be on your toes. A few bad trades, or even a single one if it’s risky enough, can put you in violation of drawdown limits.

⚠️ Caution Zone: If you’re trading in a prop firm that monitors drawdown against equity, be prepared for a more dynamic, and potentially stressful, trading environment. Your risk management game needs to be on point.

The Hybrid Approach: A Trap for Traders?

Just when you thought you had it all figured out, here comes a curveball: the hybrid approach. This unique method in the world of prop trading blends elements of both fixed drawdown, calculated from your account balance, and relative drawdown, monitored against your equity. Confused? Don’t worry, we’ll break it all down for you.

The Hybrid Method Explained

- Calculating from Balance (Fixed Drawdown Element): The drawdown is initially calculated using your balance, which is a more stable and predictable figure. This is similar to a fixed drawdown where the limit is set based on a fixed starting point.

- Monitoring Against Equity (Relative Drawdown Element): On the flip side, the prop firm keeps an eye on your equity for real-time risk assessment. This is akin to relative drawdown, which adjusts based on the highest point your account has reached.

🤔 What’s the Point?: This hybrid method aims to combine the stability and predictability of fixed drawdown (calculated from balance) with the real-time risk assessment capabilities of relative drawdown (monitored against equity). It’s like having your cake and eating it too—but there’s a catch.

Why This Approach is Risky for Traders

- Sensitivity to Market Fluctuations: Because this approach incorporates the relative drawdown element by monitoring equity, it’s sensitive to real-time market conditions. This makes it easier to hit a drawdown limit if the market moves against your open positions.

- Stricter Monitoring: This method essentially uses the more stable fixed drawdown element for calculating the drawdown but employs the more volatile relative drawdown element for monitoring. This makes it a stricter measure, and therefore, more likely to be violated if market conditions change rapidly.

- Complexity: The hybrid approach requires you to keep an eye on both your balance (for fixed drawdown) and your equity (for relative drawdown), making it more complex to manage your risk effectively.

⚠️ Red Alert: This hybrid method is more likely to result in traders failing the challenges. It’s a stricter, more complex system that requires deep understanding and constant monitoring to navigate successfully.

Navigating the Prop Firm Landscape

By now, you’re pretty much a pro when it comes to understanding how prop firms use drawdown. But knowing is only half the battle. How can you navigate this landscape effectively? Let’s dive into some practical tips and strategies that can help you manage drawdown and succeed in prop firm challenges.

Practical Tips for Managing Drawdown

- Understand the Rules: Before you even start trading, make sure you fully understand the prop firm’s drawdown rules. Is it balance based drawdown, equity based drawdown, or a hybrid approach? Knowledge is your first line of defense.

- Set Personal Limits: Don’t just rely on the prop firm’s drawdown limits. Set your own, more conservative limits to give yourself a safety buffer.

- Use Stop Losses Effectively: Always use stop losses to manage your risk on each trade. This can help you avoid significant drawdowns.

- Monitor Open Trades: Keep a close eye on your open positions, especially if your prop firm monitors drawdown against equity. Use real-time analytics tools to help you.

- Regularly Review Performance: Take time to review your trading performance to identify any patterns that could lead to high drawdowns. Adapt your strategy accordingly.

🛠️ Toolbox Tip: Use risk management software or tools that can alert you when you’re approaching your drawdown limit. Some platforms offer this feature, and it can be a lifesaver.

Strategies for Success

- Diversify: Don’t put all your eggs in one basket. Diversifying your trades can help mitigate risks and therefore manage drawdown more effectively.

- Leverage Wisely: High leverage can lead to higher profits, but it can also lead to significant drawdowns. Use leverage cautiously and understand its impact on your drawdown.

- Continuous Learning: The trading landscape is ever-changing. Keep updating your skills and knowledge to adapt to new market conditions.

- Community Support: Join trading forums or communities where you can learn from others, share your experiences, and get advice on managing drawdown effectively.

- Consult a Mentor: If possible, seek guidance from a more experienced trader who can provide personalized advice and strategies for managing drawdown.

🌟 Golden Rule: The key to succeeding in a prop firm challenge is effective risk management. Master this, and you’re well on your way to becoming a successful prop trader.

Conclusion

We’ve delved deep into the world of prop firms and their drawdown calculations. From understanding the basics of equity and balance drawdown to navigating the complexities of hybrid approaches, you’re now armed with the knowledge you need to tackle prop firm challenges head-on.

Key Takeaways

- Understand the Metrics: Whether it’s equity based drawdown, balanced based drawdown, or a hybrid drawdown, knowing how your prop firm calculates drawdown is crucial.

- Be Proactive: Don’t just rely on the firm’s drawdown limits. Set your own, use stop losses, and monitor your trades to manage your risk effectively.

- Stay Informed: Keep learning and adapting. The trading landscape is ever-changing, and staying updated is key to managing drawdown successfully.

- Risk Management is King: At the end of the day, effective risk management is your best strategy for succeeding in prop firm challenges.

Knowledge is power, but application is key. Use what you’ve learned here to be aware and prepared when participating in prop firm challenges. The road to becoming a successful prop trader is fraught with challenges, but with the right tools and strategies, you can navigate it like a pro.

So, are you ready to take on the prop firm world?