Table of Contents

What Is ChoCh in Forex?

In this article, we’re going to discuss what is ChoCh in Forex trading. Why is this important? Understanding market sentiment is like having a sixth sense in trading. It’s the pulse that keeps the Forex market alive and kicking. And ChoCh is your stethoscope to listen to this pulse. So, if you’re keen on making more informed trading decisions, you’re in the right place.

We’ll explain what is ChoCh in forex trading and how it differs from other market indicators, and even show you some real-world examples.

What Is ChoCh in Forex Trading?

Definition and Explanation of ChoCh – Change of Character in Forex

First things first, ChoCh is an acronym for Change of Character. In Forex trading, it refers to a shift in market sentiment. Imagine the market is a person. One moment, they’re happy and bullish; the next, they’re sad and bearish. That emotional switch? That’s your ChoCh!

ChoCh is all about identifying these emotional “mood swings” in the market to predict potential reversals.

How ChoCh Is Different from Other Market Indicators

You might be wondering, “Don’t we already have tons of indicators like Moving Averages, RSI, and Fibonacci levels?” True, but ChoCh is not just another line on your chart. It’s an observation of market behavior, a nuanced understanding of how the market is feeling.

Unlike traditional indicators, ChoCh doesn’t just rely on price data; it focuses on the market’s overall behavior, making it a unique tool in your trading arsenal.

Real-World Examples of ChoCh in Forex Trading

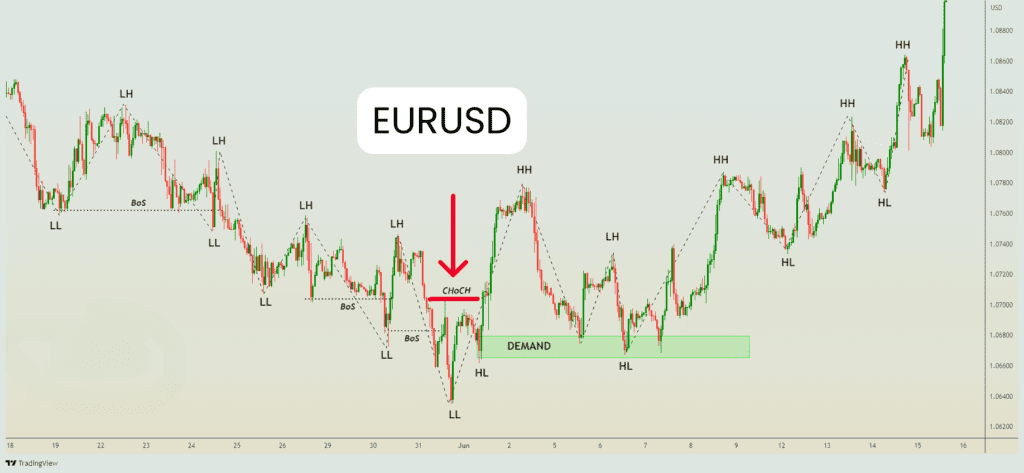

Let’s get practical! Imagine you’re trading EUR/USD. The pair has been on a bullish run, consistently forming higher highs and higher lows. Suddenly, after reaching a new high, the price sharply reverses and breaks a previous low. That’s a classic ChoCh moment, signaling that the bullish sentiment might be running out of steam.

We’ve just scratched the surface, but hopefully, you’re already getting a sense of how crucial ChoCh can be in your Forex trading journey. Stay tuned as we delve deeper into this topic.

The Importance of ChoCh in Forex Trading

Why Understanding ChoCh is Crucial for Forex Traders

Let’s get into the nitty-gritty. You might be asking, “Why should I care about ChoCh?” Well, the answer is simple: ChoCh is like your market GPS. It helps you navigate the twists and turns of the Forex market, giving you a heads-up before a major change in direction.

Think of ChoCh as your early warning system. It’s the red flag that tells you, “Hey, something’s changing here; you might want to pay attention!”

How ChoCh Can Help in Identifying Market Reversals

One of the most challenging aspects of Forex trading is identifying market reversals. Get it right, and you’re looking at potentially massive gains. Get it wrong, and well, you know the drill. ChoCh is your secret weapon here. It helps you spot those pivotal moments when the market is about to do a 180.

Here is a great example

Identifying ChoCh in Different Market Conditions

How to Spot ChoCh in Bullish Markets

In a bullish market, everything seems rosy. Prices are going up, and you’re making money. But remember, what goes up must come down. ChoCh helps you identify when the market is getting tired of climbing and might be looking to take a breather—or even a nosedive.

In bullish markets, watch for sudden breaks in higher lows or failure to make a new higher high as a ChoCh signal.

How to Spot ChoCh in Bearish Markets

On the flip side, in a bearish market, ChoCh can be your ray of sunshine. When prices are plummeting, ChoCh helps you spot the light at the end of the tunnel—a potential market bottom where things might start to turn around.

In bearish markets, keep an eye out for a failure to form a new lower low or a sudden break in lower highs as a sign of ChoCh.

ChoCh Examples

Bearish ChoCh

Imagine you’re looking at a chart where the price has been steadily climbing. You notice that after forming a new high, the price suddenly drops and breaks a previous low. That’s your Bearish ChoCh, signaling a potential end to the bullish trend.

Bullish ChoCh

Conversely, in a downtrend, if the price fails to make a new low and suddenly reverses to break a previous high, you’ve got yourself a Bullish ChoCh. This could be the first sign of a market bottom and a potential bullish reversal.

Understanding and identifying ChoCh can be a game-changer in your Forex trading strategy. Stay tuned as we dive even deeper into how to trade using ChoCh in the upcoming sections.

How to Trade Using ChoCh

Strategies for Trading Using ChoCh

So, you’re sold on the idea of ChoCh and can’t wait to implement it in your trading strategy. Awesome! But wait; let’s talk strategy first. The key to trading ChoCh effectively is to look for those pivotal moments when the market shows a change in character and then confirm it with other indicators or patterns.

Importance of Combining ChoCh with Other Trading Concepts like Order Blocks and Break of Structure (BoS)

Now, let’s add some layers to your ChoCh strategy. Ever heard of Order Blocks and Break of Structure (BoS)? These are like the peanut butter and jelly to your ChoCh sandwich. Order Blocks help you identify key levels where the market is likely to react, and BoS confirms the change in market structure.

Combining ChoCh with Order Blocks and BoS can create a robust trading strategy that offers both entry and exit points.

Combining Timeframes for ChoCh Trading

Using Higher and Lower Timeframes to Identify and Trade ChoCh

One of the best practices in ChoCh trading is to use multiple timeframes. For instance, you could use a higher timeframe like the 4-hour chart to identify potential Order Blocks and a lower timeframe like the 15-minute chart to spot the ChoCh.

Examples Using EURUSD and Other Currency Pairs

Let’s say you’re trading EURUSD. On the 4-hour chart, you identify an Order Block around 1.1800. You then switch to the 15-minute chart and notice a ChoCh forming as the price approaches this level. That’s your cue to prepare for a potential trade.

Trading ChoCh with Smart Money Concepts

How to Use Smart Money Concepts Alongside ChoCh for Better Trading Decisions

Smart Money Concepts refer to the trading behavior of institutional investors. By aligning your ChoCh strategy with Smart Money Concepts, you’re essentially riding the coattails of the big players in the market.

Smart Money Concepts can add an extra layer of validation to your ChoCh trades, increasing your odds of success.

Risks and Pitfalls

Common Mistakes When Trading Using ChoCh

Alright, let’s talk about risk management. One common mistake is relying solely on ChoCh without confirming it with other indicators or market context. This can lead to false signals and potential losses.

How Leverage Can Affect Your ChoCh Trades

Leverage can be a double-edged sword. While it can amplify your gains, it can also magnify your losses, especially if you misinterpret a ChoCh signal.

ChoCh and Backtesting

Importance of Backtesting Your ChoCh Strategies

So, you’ve got your ChoCh strategy all mapped out. Great! But before you dive into the live markets, there’s one crucial step you shouldn’t skip: backtesting. It allows you to test your strategy using historical data to see how it would have performed.

How to Use Demo Accounts for Practicing ChoCh Trading

Now, if you’re itching to get some real-time practice but aren’t quite ready to risk real money, demo accounts are your best friend. These accounts let you trade in real market conditions but with virtual money. It’s the perfect sandbox to practice your ChoCh strategies. If you are into prop trading, you can try FTMO free demo trial to get the feel of their Trading Objectives without risking anything. Alternatively, you can also try Forex.com demo account.

In Conclusion

We’ve covered everything from the basics of what is ChoCh in forex trading, its importance, how to identify ChoCh different market conditions, and even how to trade it alongside other key concepts like Order Blocks and Smart Money.

But remember, the learning never stops. The Forex market is ever-changing, and so should your strategies. We encourage you to take what you’ve learned here and implement it, but also to continue learning and adapting because inexperience can cause massive losses in the forex market.

As a final takeaway, ChoCh is not just a theoretical concept; it has practical applications that can significantly impact your trading performance. Our recommendation? Start small. Apply ChoCh in a demo account, backtest rigorously, and only then take it to the live markets.