Mitigation Block

Ever stumbled upon the term “mitigation block” and scratched your head in confusion? Trust me, you’re not alone. These jargons can sound like an alien language, but they’re actually useful in the trading world. Stick around, and you’ll learn how to wield these terms like a pro, especially when it comes to bullish and bearish mitigation blocks in forex trading.

What is a Mitigation Block?

A mitigation block is formed when there’s a sequence of price movements that includes a swing high, a retracement, and a failed swing high. This is followed by a swing low that breaks past previous lows. The ideal entry point is the closest downward closing price near this swing low.

Importance in Trading

So, why should you care about mitigation blocks? Simple. They’re like your GPS. Knowing how to read and interpret these blocks can give you a significant edge. They help you understand where the price might go next, making your trading decisions more informed and, let’s face it, more profitable.

Bearish Mitigation Block: The Guardian of Downtrends

Characteristics

Let’s talk about the bearish mitigation block. Picture this: The market is like a car going downhill. A bearish mitigation block acts like a speed bump, slowing down the descent and giving you time to think. It’s a zone where the price finds resistance, making it harder for the asset to continue its downward journey.

How to Identify a Bearish Mitigation Block?

So, how do you spot one of these bearish wonders? Keep an eye out for a price range where the asset seems to struggle to move upwards. If you notice an increase in selling volume around this range, bingo! You’ve likely found yourself a bearish mitigation block.

Bullish Mitigation Block

Characteristics

Now, let’s flip the coin and talk about the bullish mitigation block. Imagine the market as a rocket preparing for liftoff. A bullish mitigation block acts like rocket fuel, propelling the asset upwards. It’s a zone where the price finds support, making it difficult for the asset to lose its upward momentum.

How to Spot a Bullish Mitigation Block?

So, you’re probably wondering, how do you identify a bullish mitigation block? Look for a price range where the asset resists a downward move. If you see buyers stepping in and the volume of purchases increasing, you’ve likely found your bullish mitigation block. It’s like spotting a trampoline on the ground that’s ready to bounce the asset back up!

The Role of Mitigation Blocks in Forex Trading

So, you’re intrigued by the concept of mitigation blocks, also commonly referred to as hedging strategies in the forex world. But what exactly is a mitigation block in forex? Picture it as your secret playbook, a set of cheat codes if you will, in the high-stakes game of forex trading. In a market that’s as unpredictable as it is lucrative, mitigation blocks serve as your personal trading advisors. Whether you’re dealing with bullish or bearish mitigation blocks, they help you pinpoint the ideal zones for entering or exiting a trade. In essence, they’re whispering in your ear, advising you when to buy low and when to sell high.

How Do Mitigation Blocks in Forex Work?

In the realm of forex, mitigation blocks function as a risk management tool by opening a counter-position to neutralize the risk of an existing trade. Let’s say you’ve gone long on a currency pair like EUR/USD. To hedge your bets, you could open a short position on the same pair. This counter-move acts as a safety net, ensuring that if the market turns against your original long position, the gains from your short position will cushion the blow.

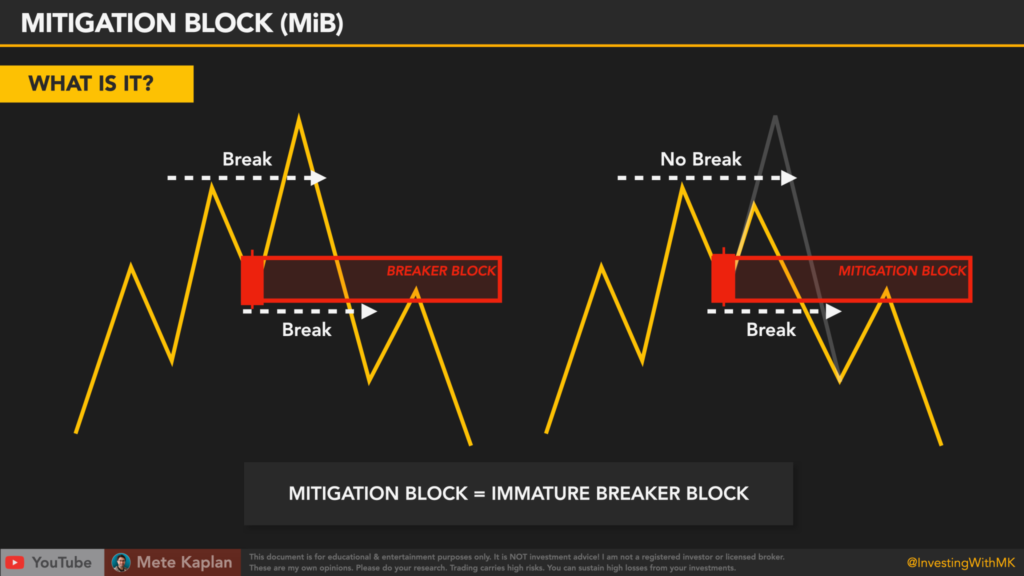

Mitigation Block vs Breaker Block

Differences

So, you’ve heard about both mitigation blocks and breaker blocks, but what sets them apart? Great question! Think of a mitigation block as a cushion or a buffer—it softens the impact of price movements. A breaker block, on the other hand, is more like a sledgehammer. It aims to shatter resistance or support levels, making way for a new trend. While mitigation blocks are more about stability, breaker blocks are all about disruption.

Which One to Use?

Choosing between a mitigation block and a breaker block is like choosing between a scalpel and a chainsaw; it all depends on what you’re trying to achieve. If you’re looking for a more conservative, risk-averse approach, mitigation blocks are your go-to. But if you’re feeling adventurous and are willing to take on more risk for potentially higher rewards, breaker blocks might be more up your alley.

How to Trade Using Mitigation Blocks: Your Step-by-Step Guide

Strategies

Ready to put your newfound knowledge to the test? Here are some strategies you can employ when trading with mitigation blocks:

- Trend Following: Use bullish mitigation blocks as entry points in an uptrend and bearish mitigation blocks as exit points in a downtrend.

- Counter-Trend: Look for bearish mitigation blocks in an uptrend as potential reversal points, and vice versa.

- Breakout Strategy: Use mitigation blocks as a basis for setting up breakout trades, entering the trade when the price moves beyond the block.

Risk Management

Let’s talk about the elephant in the room—risk. Trading is inherently risky, but that doesn’t mean you can’t be smart about it. Always set stop-loss orders when trading with mitigation blocks. Think of it as your safety net, there to catch you if things don’t go as planned. Also, never invest more than you can afford to lose. It’s not just good advice; it’s a rule to live by in the trading world.

Common Mistakes to Avoid: The Pitfalls of Misusing Mitigation Blocks

Alright, let’s get real for a moment. Even the best tools can become liabilities if misused. Here are some common mistakes you should steer clear of when using mitigation blocks:

- Overreliance: Don’t put all your eggs in the mitigation block basket. Use other indicators to confirm your strategy.

- Ignoring Market Context: A bullish mitigation block in a bearish market? Be cautious; it might be a trap!

- Poor Risk Management: Failing to set stop-loss orders can turn a small mistake into a financial disaster.

The Upside: Benefits of Using Mitigation Blocks

Now that we’ve covered the don’ts, let’s talk about the dos—or rather, the ‘whys.’ Here are some compelling reasons to incorporate mitigation blocks into your trading strategy:

- Predictability: Mitigation blocks, be it bullish or bearish, offer a higher degree of predictability in an otherwise volatile market.

- Risk Management: They serve as natural points for setting stop-loss and take-profit orders, helping you manage risk more effectively.

- Strategic Entry and Exit: Understanding mitigation blocks in forex can help you time your entries and exits more strategically, maximizing your gains.

The Downside: Drawbacks and Limitations of Mitigation Blocks

No tool is perfect, and mitigation blocks are no exception. Here are some limitations to keep in mind:

- False Signals: Sometimes, what looks like a mitigation block may actually be a ‘fakeout,’ leading you into a bad trade.

- Not Foolproof: While they offer a degree of predictability, mitigation blocks are not a guarantee. Market conditions can change rapidly, rendering them ineffective.

- Requires Skill: Properly identifying and utilizing mitigation blocks, especially when distinguishing between mitigation block vs breaker block, requires a good understanding of market analysis.

Conclusion: Your Blueprint for Trading Success with Mitigation Blocks

In a nutshell, mitigation blocks are more than just trading jargon; they’re your roadmap to more strategic and informed trading. These blocks, be they bullish or bearish, serve as your guiding stars in the often chaotic universe of forex trading. They offer a framework for better predictability, effective risk management, and smarter entry and exit strategies. But remember, they’re not a magic wand. Like any tool, they have their limitations and should be part of a broader, well-thought-out trading strategy. Armed with this knowledge, you’re now better prepared to tackle the intricacies of forex trading, whether you’re deciphering a bullish mitigation block or choosing between a mitigation block and a breaker block. The road to trading mastery just got a little less bumpy.