Table of Contents

History of Prop Trading

Discover the ins and outs of proprietary trading, including its historical evolution that shapes the history of prop trading as we know it today. This guide delves into its burgeoning role in both traditional and crypto finance, offering actionable insights and practical tips to enhance your trading career with prop firms. Whether you’re a novice or a seasoned trader, understanding the history of prop trading can equip you with valuable knowledge for a successful trading journey.

Introduction

Proprietary trading, often abbreviated as prop trading, is a multifaceted financial practice that involves firms lending their own capital to traders. These traders then use this capital to make trades, with the profits being shared between the firm and the trader. This comprehensive guide aims to demystify prop trading, offering a deep dive into its history, its impact on various financial markets, and the pros and cons you should consider.

Quick Summary:

- Proprietary trading involves firms using their own capital to trade in the market, often through third-party traders.

- Prop trading has evolved to include cryptocurrencies and forex, offering more flexibility and higher profit splits for traders.

- To join a prop trading firm, traders usually undergo a series of prop firm challenges to demonstrate their market proficiency and risk management skills.

What Exactly Are Prop Firms?

If you’re new to trading, you might have heard the term “prop firm” but are unsure what it entails. A prop firm is essentially a company that provides traders with capital in exchange for a share of the profits generated. These firms offer a plethora of benefits, including access to large capital, sophisticated trading tools, and mentorship from experienced traders. Prop firms exist to help traders succeed, offering incentives and bonuses to encourage trading activity.

How Can Prop Firms Elevate Your Trading Skills?

- Access to Capital: One of the most significant advantages of trading with a prop firm is the access to large amounts of capital. This enables you to trade with larger position sizes and assume more risk, potentially leading to higher profits.

- Training and Education: Many prop firms offer educational programs that teach you the intricacies of trading and effective strategies.

- Support and Mentorship: Prop firms often have a team of seasoned traders who can provide invaluable support and mentorship, especially useful for those new to the industry.

- Risk Management: These firms usually have risk management teams to help you manage your trading risks effectively.

- Advanced Technology: Prop firms often provide cutting-edge trading technology, including platforms, data feeds, and analytical tools, giving you an edge in the market.

A Brief History of Prop Trading

The Evolution of Proprietary Trading in Traditional Finance

Proprietary trading has a storied history, particularly within the realm of traditional finance. As financial markets became more sophisticated throughout the 20th century, the role of proprietary trading grew in parallel. Investment banks and financial institutions saw the potential for significant profits and established specialized desks where skilled traders could use the bank’s capital to trade various financial instruments.

The Golden Era: Pre-2008

Before the 2008 financial crisis, proprietary trading was often considered the crown jewel of many investment banks. It was a high-risk, high-reward venture, and the traders who excelled in this environment were among the most highly compensated in the industry. During this period, proprietary trading desks operated with relatively few restrictions, aiming to outperform the market and generate substantial profits for their parent institutions.

The Turning Point: The 2008 Financial Crisis

The landscape of proprietary trading underwent a seismic shift following the 2008 financial crisis. The crisis exposed systemic risks in the financial industry, leading to a loss of confidence among investors and regulators alike. In response, the United States government enacted the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010.

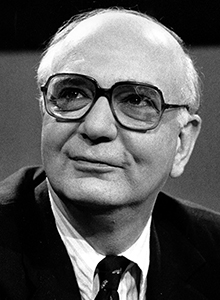

The Dodd-Frank Act and the Volcker Rule

One of the most impactful components of the Dodd-Frank Act was the Volcker Rule, named after former Federal Reserve Chairman Paul Volcker. This rule aimed to increase consumer protection and reduce systemic risk by placing stringent restrictions on the types of activities banks could engage in. Specifically, the rule severely limited the proprietary trading activities of banks, essentially barring them from making speculative trades with their own capital. This led many banks to dismantle their proprietary trading desks, fundamentally altering the landscape of proprietary trading in traditional finance.

The Aftermath: A Shift in Focus

The restrictions imposed by the Volcker Rule led to a migration of talent and capital away from banks and towards hedge funds, private equity firms, and independent trading firms. These entities were not subject to the same regulatory constraints, allowing them to adopt more flexible and aggressive trading strategies. As a result, the center of gravity for proprietary trading shifted, marking the end of an era for proprietary trading within traditional banking institutions.

By understanding this historical context, you can better appreciate the current landscape of proprietary trading. The regulatory changes have made it a less prominent feature within traditional banks but have also paved the way for new opportunities and strategies in other types of financial institutions.

In Modern Markets

In recent years, the focus has shifted towards cryptocurrencies and forex markets. New-age firms like FTMO, FXIFY, and SurgeTrader have emerged, adapting the traditional model to suit the needs of modern traders.

How to Choose the Right Prop Firm

Selecting the right prop firm is crucial for your trading career. Here are some tips to guide your decision:

- Alignment of Goals: Ensure the firm’s objectives align with your investment goals.

- Reputation: Look for firms with a strong track record and excellent reputation in the industry.

- Customer Service: Make sure the firm offers excellent customer support and is responsive to your needs.

- Fees and Platform: Consider the fees charged and ensure that the trading platform is robust and user-friendly.

Risks and Safeguards When Trading with Prop Firms

Trading with prop firms carries higher risks compared to traditional brokers, mainly due to fewer regulatory protections. It’s crucial to understand the terms of your agreement and be aware of the risks involved. To stay safe:

- Understand the Agreement: Make sure you fully understand the terms and conditions.

- Be Risk-Aware: Always be conscious of the risks involved in trading.

- Use Trusted Brokers: Opt for brokers that are reliable and trustworthy.

- Ask Questions: Don’t hesitate to clarify any doubts or concerns you may have.

Self Trading vs Prop Trading

When it comes to trading, one of the most crucial decisions you’ll make is whether to trade on your own or to join a proprietary trading firm. Both options have their merits and drawbacks, and understanding these can help you make an informed decision that aligns with your trading goals and risk tolerance. Below, we break down the key differences between self-trading and prop trading in an easy-to-understand format.

| Aspect | Self Trading | Prop Trading |

| Capital | Traders use their own capital, which may limit their ability to trade at scale. | Large capital is borrowed from the prop firm, offering the potential for higher profits. |

| Risk | Traders are fully responsible for the risks they take and bear all consequences. | Risk is often carried by the prop firm, reducing individual exposure for the trader. |

| Reward | All profits go to the trader, subject only to taxes. | Profits are shared with the prop firm, with the exact split varying from one firm to another. |

| Starting Conditions | No special requirements other than an exchange account and initial capital. | Traders must pass challenges and verification processes to become eligible for trading. |

| Tools and Analytics | Basic tools and indicators are freely available, but high-quality tools often require a subscription or coding skills. | Prop firms provide advanced analytical tools and algorithms to maximize profitability. |

| Flexibility | Traders have complete freedom to execute any trading strategy. | Prop firms may impose restrictions on trading strategies to protect their capital. |

Conclusion

Proprietary trading offers a lucrative but challenging avenue for traders. With the right skills, risk management strategies, and the support of a good prop firm, you can make a rewarding career out of trading. Whether you’re interested in traditional finance or emerging markets like cryptocurrencies, prop trading offers a platform for growth and excellence.

By understanding the complexities and benefits of prop trading and prop firms, you’re now better equipped to navigate this rewarding yet challenging field. With hard work and dedication, you could become a successful trader, leveraging the resources and opportunities that prop firms provide.

![Funded Picker Review (2025) + 15% Discount Code [PFR15] 10 funded picker](https://propfirmreviews.net/wp-content/uploads/2025/08/funded-picker-1024x576.jpg)