Table of Contents

What is the Eightcap Challenge?

In essence, Eightcap Challenges work like this: Challenges are offered by certain partners, known as Referrers, but it’s Eightcap that manages and administers these Challenges, not the Referrers. While Referrers may promote and refer traders to Eightcap, they don’t directly handle the challenges, access trading platforms, or manage funds related to these challenges. Instead, Eightcap takes care of subscriptions, fees, handling all related money, managing the technology and platforms for the challenges, and resolving any disputes. Payments related to the challenges are processed through Eightcap’s trusted banking and finance partners.

Prop Firms Collaborating with Eightcap

Eightcap collaborates with numerous prop firms in its Challenge, including:

- QuanTech Trading

- SuperFunded

- M Solution

- Infinity Forex Funds

- MENA Funding

- Fast Forex Funding

- The City Traders

- Invlyft

- Global Forex Funds

- Waka Funding

- One of One Funding

- MI Funder

- Tradicave

- Funds for Traders

- AlpiCap

- Sure Leverage

- Genesis Forex Funds

- Only-Funds

- ProTrade Funded

- Social Trading Club Funding

- Get Mega Funded

- Next Step Funded

- Pip Traders Funding

- Over-Funded

- PPF Trader

Eightcap Review

Eightcap, a Melbourne-based trading platform, has been in the spotlight for a variety of reasons, both positive and negative. On one hand, it has recently made headlines for terminating its services for prop trading firms. This decision, effective from February 29, 2024, aligns with similar actions between other proprietary trading firms and their brokerage providers. Eightcap’s CEO mentioned that ending commercial arrangements is not uncommon in the industry and has been part of their ordinary commercial activities previously. This move reflects broader industry trends, as MetaQuotes, the entity behind MetaTrader 4 and 5, tightens regulations on proprietary trading firms, especially concerning U.S. clients. This has led to a reshuffling of services among prop trading firms, with some finding new brokerage partners to continue operations.

Is Eightcap Regulated?

From a regulatory and operational standpoint, Eightcap is known for adhering to strict financial regulations. It maintains segregated accounts to ensure that clients’ funds are protected and conducts regular reporting to financial authorities, showcasing its commitment to transparency and client security. Moreover, it uses an independent external auditor to monitor its capital adequacy and performs daily client money reconciliation. Eightcap is also covered by professional indemnity insurance, which adds an extra layer of security for its clients.

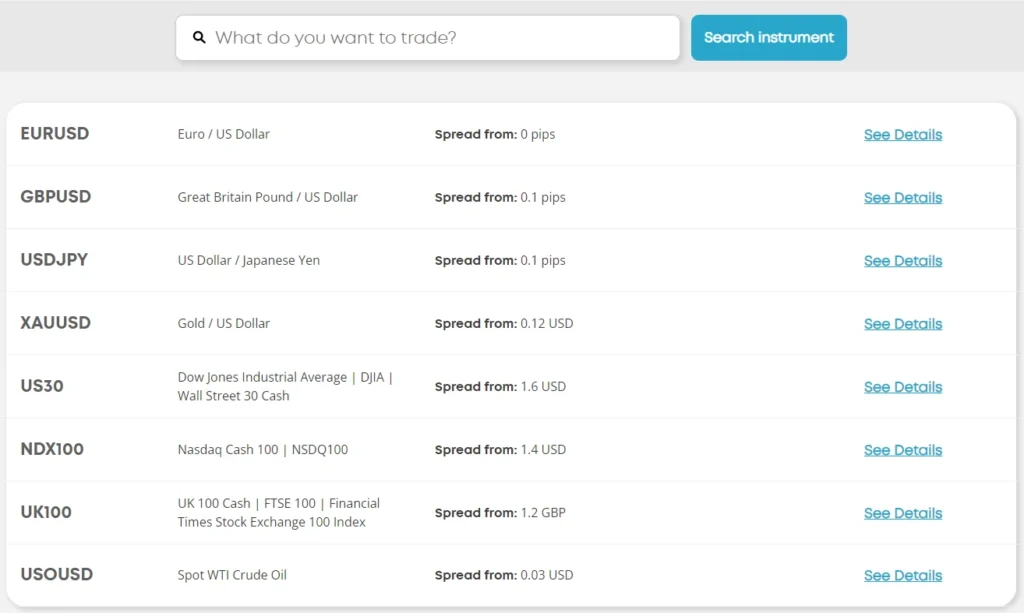

On the services side, Eightcap offers a broad range of trading assets including forex, equities, commodities, and cryptocurrencies, with leverage options that can reach up to 500:1. This high leverage can be both an opportunity and a risk, depending on the trader’s experience and risk management strategies. The platform provides two account types, Standard and Raw, with competitive spreads and commissions. However, it’s important to note that high leverage, while attractive, necessitates careful risk management to prevent significant losses.

Concerns about Eightcap primarily revolve around the potential risks associated with high leverage trading, which can lead to significant losses, especially for inexperienced traders. Despite these concerns, Eightcap is praised for its regulatory compliance, having a license from the Australian Securities & Investments Commission (ASIC) and offering services under its Vanuatu branch regulated by the VFSC. This regulatory backdrop provides a level of reassurance about Eightcap’s legitimacy and operational standards. The broker has been active since 2015 and has built a reputation for offering a reliable trading experience, supported by MetaTrader 4 and MetaTrader 5 platforms, and a comprehensive education section.

Eightcap Broker Spreads

Despite some isolated complaints about connection speeds, spread increases, and bad fills during news announcements, overall sentiment from users is positive, with high ratings on Trustpilot and Google Reviews. This suggests that while there are some areas of improvement, many users are satisfied with the service provided by Eightcap.

In Conclusion

While Eightcap has faced some criticism, particularly related to its recent decision to cease services for prop trading firms, it remains a platform that adheres to strict regulatory standards, offers a wide range of trading options, and is generally well-regarded by its users. As with any trading platform, potential users should carefully consider their own trading experience and risk tolerance, especially when trading with high leverage.

Reflecting on the Eightcap Challenge

Prop firms partnered with the Eightcap Challenge display a banner certifying their collaboration with Eightcap Global. These firms act as referrers, while Eightcap Global manages the challenges, including financial transactions and providing access to the trading platform.

The Eightcap Challenge, managed by a regulated and trustworthy broker like Eightcap, introduces a level of fairness and transparency rarely seen in prop trading. This arrangement minimizes the risk of manipulative practices that could unfairly cause traders to fail. However, the current partnership with smaller prop firms, rather than the industry giants, raises questions about how this initiative will influence the broader prop trading market. Time will unveil the true impact and acceptance of the Eightcap Challenge in the competitive world of trading.