Table of Contents

Copy trading has become a popular way for traders to manage multiple accounts by replicating trades across various platforms and brokers. This automated trading solution allows for seamless copying of trades from a primary account (the Parent) to one or more secondary accounts (the Child), making it particularly useful for traders who manage several portfolios. This blog will explore how to set up copy trading across multiple accounts using platforms like Quantower, ATAS, and Binance.

What Is Copy Trading?

Copy trading is an automated trading strategy where the trades from a provider account are replicated across one or more follower accounts. This process is commonly used in the cryptocurrency and forex markets, allowing traders to duplicate successful trading strategies across multiple accounts, diversifying their investments.

Key Features of Copy Trading:

- Provider (Parent) and Follower (Child) Accounts: Trades initiated in the provider account are copied to follower accounts based on pre-defined parameters.

- Proportional Allocation: Follower accounts replicate trades in proportion to their available capital.

- Platform Integration: Platforms like Quantower, ATAS, and Binance allow users to configure copy trading settings for optimal performance.

How to Set Up Copy Trading on Quantower

Quantower offers a robust copy trading feature that allows you to duplicate trading activity across multiple accounts, all within one platform. Here’s how to set it up:

- Create a Copy-Bot: Use Quantower’s Copy Trading Panel to configure a bot to automate the copying of trades between the Parent and Child accounts. This bot will handle all replication tasks based on your settings.

- Manage Connections: Quantower enables users to link multiple accounts, whether they are within the same broker or across different brokers. For instance, trades from a CQG account can be copied to a Rithmic account, provided that proper symbol mapping is configured.

- Set Copying Modes: Quantower offers two main modes of copying:

- Percentage Mode: The bot replicates trades based on a percentage of the Parent’s account balance.

- Multiplier Mode: The bot multiplies the Parent’s order size by a specified coefficient for each Child account.

- Monitor Activity: With Quantower’s visual control features, you can monitor the synchronization of trades across multiple accounts. Any changes made in the Parent account, such as order modifications or cancellations, are automatically reflected in the Child accounts.

Copy Trading on ATAS

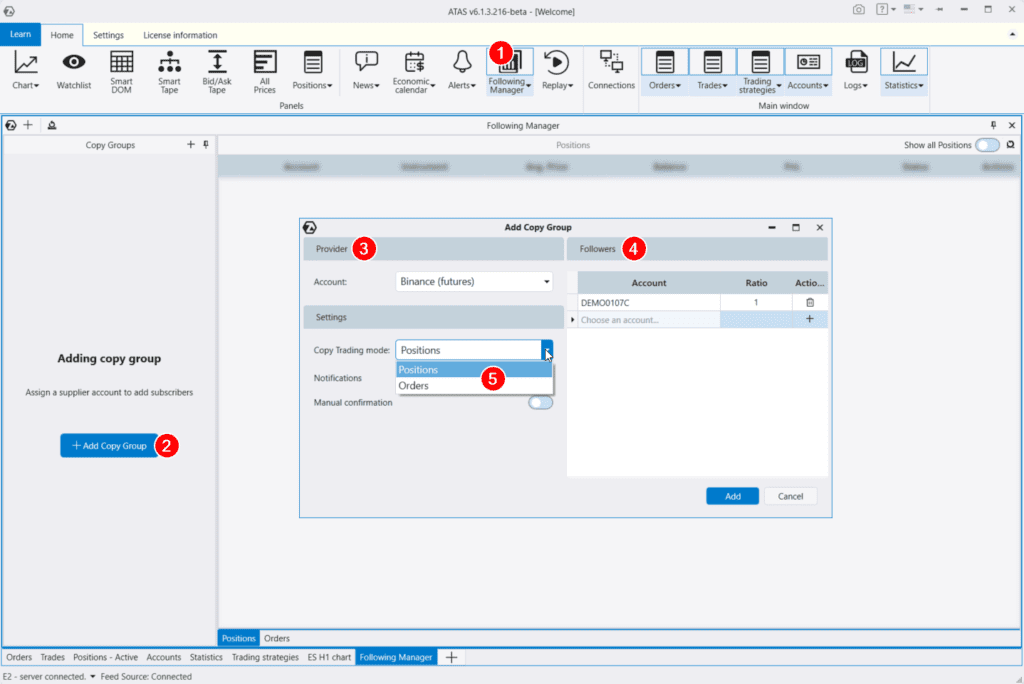

ATAS also provides a reliable copy trading solution, especially for those managing multiple personal accounts or followers. The Following Manager in ATAS simplifies this process:

- Configure the Following Manager:

- Open the Settings Window and create a group of accounts.

- Assign a Provider Account, which is the main account from which trades will be copied.

- Add Follower Accounts and configure the Ratio Parameter to set the proportion of copied trades relative to the follower’s capital.

- Choose the Copying Mode:

- Positions Mode: Copies entire positions (including open and closed trades).

- Orders Mode: Copies individual trades/orders based on the Parent account’s activity.

- Initiate the Copy Trading Process: Once set up, click the Play button to start the copy trading process. All trades from the Parent account will be automatically copied to the Follower accounts in real time.

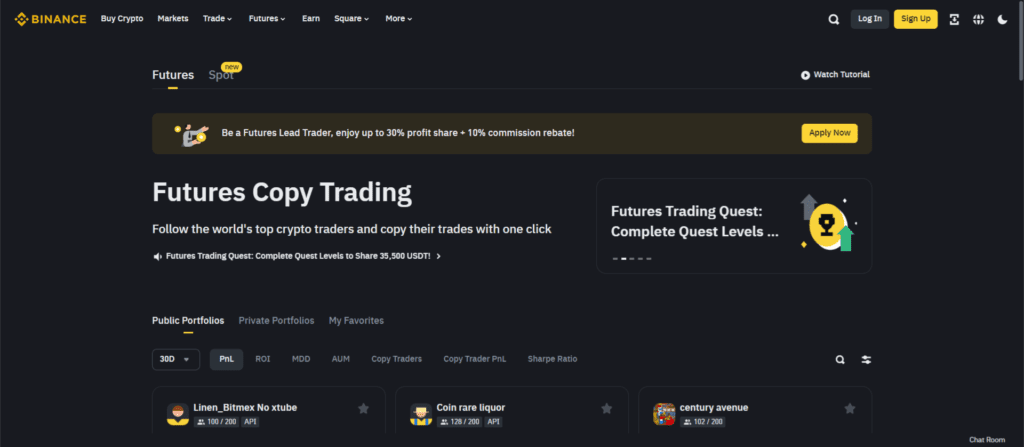

Copy Trading on Binance for Cryptocurrencies

For cryptocurrency traders, Binance offers a straightforward copy trading feature that allows you to follow experienced traders and replicate their strategies:

- Register and Fund Your Account: Open a Binance account and fund it with the required capital.

- Choose a Provider Trader: On Binance’s Copy Trading Page, select a trader based on performance metrics like profit size or drawdown.

- Configure Settings: Define how much capital to allocate to the copy trading process and set up stop-loss criteria, such as halting the copying when drawdown exceeds a specified percentage.

- Start Copying Trades: Click the Copy button, and Binance will automatically replicate the provider’s trades to your account. You can stop copying at any time or manually adjust the settings to optimize your strategy.

Benefits of Copy Trading

Copy trading offers numerous advantages for those managing multiple accounts:

- Diversification: Spread risk by replicating trades across different markets or assets.

- Time Efficiency: Automates the trading process, reducing the need for manual intervention.

- Educational Value: By following experienced traders, beginners can learn effective trading strategies and gain insight into market movements.

Risks Involved in Copy Trading

While copy trading can be highly effective, it does come with risks:

- Market Volatility: Even the best traders can experience losses, and those losses will be replicated in follower accounts.

- Technical Issues: There may be slight delays or slippage between the execution of orders in the Parent and Child accounts.

- Reliance on Providers: Followers may become overly reliant on the provider’s trading strategy, neglecting the development of their own trading skills.

Best Practices for Managing Multiple Accounts

Whether you’re using Quantower, ATAS, or Binance, here are some tips for managing multiple accounts efficiently:

- Test on Demo Accounts: Before diving into live trading, it’s wise to test your copy trading strategy on demo accounts to understand the platform’s behavior and minimize risks.

- Monitor Logs: Platforms like Quantower and ATAS provide detailed logs of all copy trading activities. Regularly reviewing these logs ensures that trades are being executed as expected.

- Consolidate Accounts: If you’re trading across multiple brokers, it’s essential to consolidate accounts under a single connection. This not only simplifies the management process but also ensures regulatory compliance.

- Set Stop-Loss Parameters: Configure stop-loss settings to protect your capital from significant drawdowns. This is particularly useful when copying trades from multiple provider accounts.

Conclusion

Copy trading is an invaluable tool for traders who manage multiple accounts, offering the ability to automate and replicate trading strategies with ease. Platforms like Quantower, ATAS, and Binance offer powerful features that simplify the process, allowing traders to diversify their investments and save time. However, it’s important to remain vigilant, monitor trades, and use risk management strategies to protect your capital.

Whether you’re a beginner looking to learn from experienced traders or a professional managing multiple portfolios, copy trading offers a versatile and efficient solution. Start automating your trades today by setting up copy trading on Quantower, ATAS, or Binance and take your trading strategy to the next level.

![Funded Picker Review (2025) + 15% Discount Code [PFR15] 3 funded picker](https://propfirmreviews.net/wp-content/uploads/2025/08/funded-picker-1024x576.jpg)